In just over a month, home sales in Toronto have declined over 80% year-over-year; home prices have dropped for the first time in years, while the overall activity in the market continues to take a "nose dive" as a result of the coronavirus pandemic.

And as rental demand begins to decline as more residents lose their jobs and some development projects are put on hold, Toronto's rental market could start to take on a very different shape in the months to come.

But, while some experts have said the chance of a coronavirus-related housing market crash remains low, Shaun Hildebrand, head of development-tracking market research firm Urbanation, says condo rents in Toronto could be lower post-COVID-19.

“As rental demand declines as job losses mount, incomes are reduced, and immigration shrinks, the slowing in the GTA rental market that appeared in the last half of March will progress for at least the next few quarters given the current economic outlook," said Hildebrand. "The impact on rents will be something to watch, which will also be influenced by the timing of the record number of units that were expected to complete this year.”

While some construction in the city has come to a halt, other construction sites are still operating under the new state of emergency measures currently in place, which will later add more supply to Toronto's rental market.

RELATED:

- There’s Been Up to a 500% Increase in Online Virtual Home Tours in Canada

- Toronto Home Sales Drop More Than 80% Year-Over-Year in Second Week of April

- ‘Unprecedented’ Number of Canadians Looking to Refinance Mortgages: Report

- How Toronto’s Real Estate Industry is Dealing with the Impact of Coronavirus

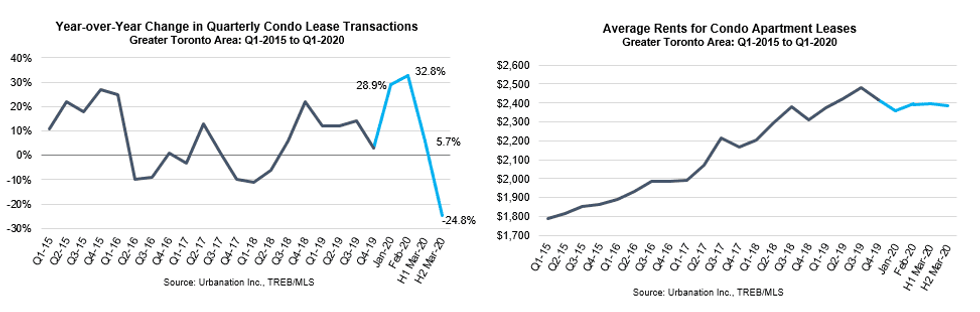

According to Urbanation, there were 7,200 units leased in the first quarter of 2020, marking the highest Q1 total on record. However, this growth noticeably shifted after March 16.

The pre-COVID-19 period within the first quarter saw year-over-year growth in leases of 25%, while the post-COVID-19 period saw a steep decline in activity, with lease volume down 25% compared to the same period a year earlier — down 39% compared to the first half of March, Urbanation reports. Additionally, the supply of rentals dropped only 7% during the same period.

Hildebrand says the sharp decline in rental transactions can clearly be related to the impact of the protective measures and economic uncertainty already caused by COVID-19, demonstrating how quickly the market is being impacted.

Looking ahead, the outlook for rents will largely depend on the severity and duration of the economic downturn — which remains highly uncertain at this point — and the resulting impact the pandemic has on vacancies, says Hildebrand.

"Due to the lag between job losses and vacancies (tenants are required to provide at least 60 days notice), as well as government income support, the temporary ban on eviction orders and the general willingness of landlords to work with tenants on rent payments, the anticipated rise in rental supply and potential downward pressure on rents may not surface until later in 2020," said Hildebrand.

Hildebrand says the second quarter was supposed to see a record of some 10,000 condominiums and 1,000 purpose-built rentals reach occupancy — most of which will now occur later in the year and over the next 18 months.

This delayed supply, coupled with more residents becoming unemployed and not looking to move will add even more pressure on rents and could potentially bring some relief for renters in the months following the end of the pandemic.

"Because condo rentals are owned by individual investors, who are motivated to rent their units out as soon as possible to offset ownership carrying costs, condo rents may adjust lower more quickly than purpose-built units owned by larger corporations with more capital and longer-term investment horizons that can better manage vacancies," explained Hildebrand.

"Condo investors will have room to accept lower than current market rents and still maintain neutral cashflow. For units scheduled to reach completion in 2020, carrying costs are projected at approximately $3.35 per-square-foot. By comparison, rents for newly registered units have reached an average of $3.73 per-square-foot — 11% higher than projected carrying costs."

Rent relief is exactly what Toronto tenants need right now, as the city remains the most expensive rental market in the country.

According to a recent report from PadMapper, one-bedroom rent managed to maintain a month-over-month gain of 0.9% to settle at $2,250 in April, while two-bedroom rents rose 2.8% to $2,950 in the same period.