According to the recently-released Staff Recommended Operating and Capital Budgets, Toronto residents could see their property tax rate increase by 2.53% in the year ahead.

If unchanged before the Budget Committee's final wrap-up on February 4, this increase will see the tax on an average home's value reach $3,201 for 2021.

This year, officials declare an investment of $1.7 billion -- in collaboration with all levels of government -- aims to support residents and businesses through the impacts of COVID-19. Particular facets of the community being prioritized include public health, economic response, transportation and mobility, housing and shelter, and the modernization of city services.

Under the recommendations for Toronto's 2021 budget, property taxes would increase 0.33%. When paired with the overall budget increase of 0.7%, and the 1.5% proposed for the City Building Fund -- which addresses transit and housing -- the total impact closes at 2.53%.

The rise of just over 2.5% remains slim compared to last year's increase. In 2020, property taxes for residents went up 4.24% from the year prior, reaching $3,141 for an average home.

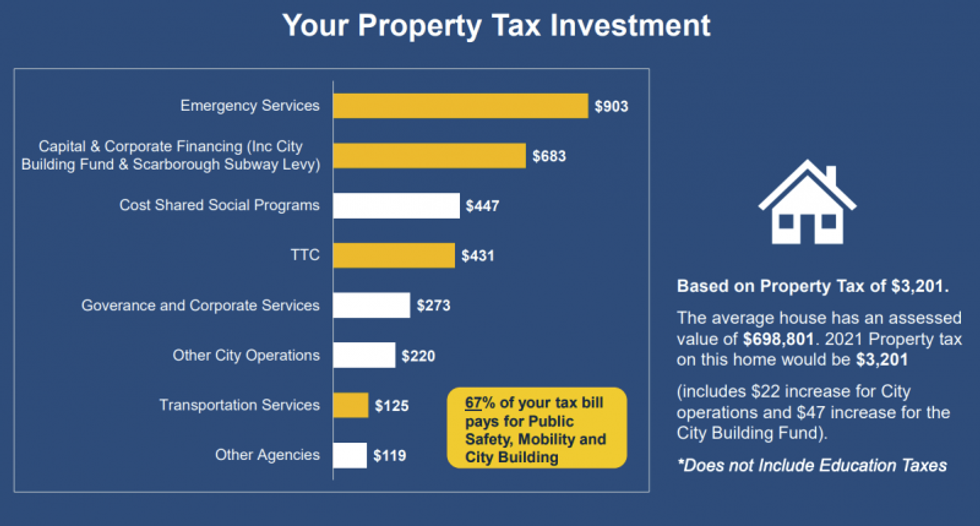

According to the proposed budget, for the average residential home assessed at $698,801, residents would pay an additional $79 on their property taxes in 2021; a sum total of $22 for the city's budget increase, $47 for the City Building Fund, and $10 for policy impact.

READ: New Housing Starts in Toronto up 43% Year-Over-Year in December

Where property taxes are concerned, the proposed budget see the residential type increase by the most at 0.7. Business property taxes are poised to rise by 0.35% -- half of the residential increase, as per policy -- while industrial taxes would rise 0.23%; that's one third of the residential increase, also per policy.

Multi-residential taxes would see no increase, per regulation, city documents say.

Justly, residents may wonder where their property tax investment is allocated, once in the proverbial hands of the municipality. According to this year's budget presentation, 67% of citizens' tax bills go toward public safety, mobility, and city building. This includes emergency services, social programming, transportation services and -- separately -- the TTC, among other resources.

These services and resources are among those with revenues impacted by COVID-19, the city says. Reduced user fees on transit, increased public health, shelter, enforcement and related costs, continued delivery of city services, and growing digital economy are all cited as spaces where the municipality felt the impacts of the pandemic through the last year.

In these areas, the city says, "support from government of Canada and province of Ontario continues to be critical to offset the financial gap."