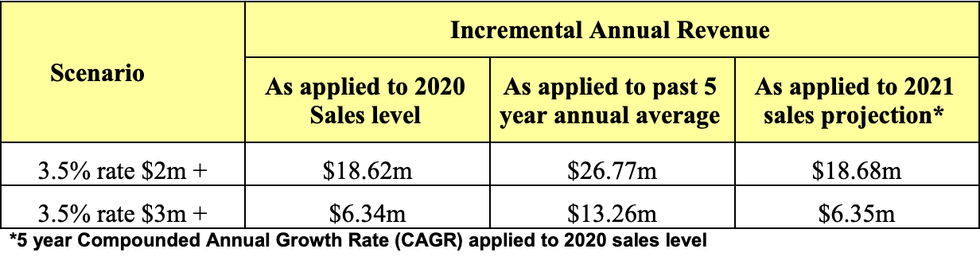

Toronto could see an additional $18.7 million in revenue this year if city council approves a proposed luxury home tax.

In a move to balance the books at City Hall and generate revenue to pay for things the city needs, such as transit and affordable housing, councillors are exploring implementing a luxury home tax on higher-end properties.

Currently, properties valued at more than $2 million are subject to a municipal land transfer rate of 2.5%, in addition to provincial fees. However, if this was bumped up another 1%, it would generate the aforementioned additional revenue.

READ: Toronto’s Proposed Luxury Home Tax Not a Permanent Solution, Says Sotheby’s CEO

According to a Toronto budget briefing note, as an example, adjusting the rates 1.0% higher (from 2.5% to 3.5%) on property sales with a value of consideration higher than $2 million could yield an additional $18.7 million. If the threshold was set at properties worth $3 million, the city would generate an additional $6.4 million.

City staff said implementing new upper tiers and rates on values could have negative, yet transitional, impacts on the housing market.

Staff said a new municipal land transfer tax tier would incentivize buyers and sellers to transact below the cut-off. The increased transaction costs from graduated rates could also slightly reduce the liquidity of real estate, particularly in the luxury homes market, which staff says is now showing some signs of decline.

However, staff said the changes could discourage current homeowners from up-sizing to lower-end luxury homes, which could potentially tighten the housing supply for mid-value homes.

While the luxury home tax could help the city generate much-needed additional revenue, some luxury real estate specialists think it may discourage some buyers from buying bigger homes.

"As of right now, the real estate sector is helping our economy, and if the government decides to implement this tax, it may make some buyers shy away from buying a bigger home in Toronto," Dorian Rodrigues a Broker with PSR told Toronto Storeys.

"I understand why they’re doing it but it won’t actually help our economy at all, it’ll just make things worse."

This proposed tax would be similar to what’s already been implemented in Vancouver, which Sotheby’s International Realty Canada CEO, Don Kottick, has said caused unintentional negative consequences for homebuyers.

“It stalled activity in the market for luxury housing over $3 million, therefore many people delayed decisions to move up or out and their homes did not come on the market. This trickled across many segments of the market, such as for attached homes which are popular with young families and downsizers, and contributed to a lack of supply and housing options,” said Kottick.

Kottick says there is often the assumption that taxes are the only way to generate government income and to solve housing affordability challenges. However, a permanent solution for Toronto’s housing market won’t be the proposed luxury home tax, said Kottick.

“Taxes can be like crack to governments: the land transfer tax was only meant to be a temporary tax and is now permanent as the government is dependent upon it. This proposed luxury home tax poses the same risk of being a permanent tax without offering a permanent solution.”

However, Kottick believes governments should be looking at implementing more sustainable solutions that don’t have the unintended negative consequences that often come with heavy taxation.

If approved by city council, the tax changes would require at least two months to implement, according to city staff.