As COVID-19 continues to disrupt every major industry, including the housing market, experts say they believe there's a "low risk" that the effects of the pandemic will lead to a market collapse.

According to a new report from RBC, the Canadian housing market experienced a slowdown in the last two weeks of March, and it's expected to continue across the country in April and for as long as social distancing and lockdown measures remain in effect.

READ: First Effects of COVID-19 Begin to Show Up in Toronto Home Sales: Report

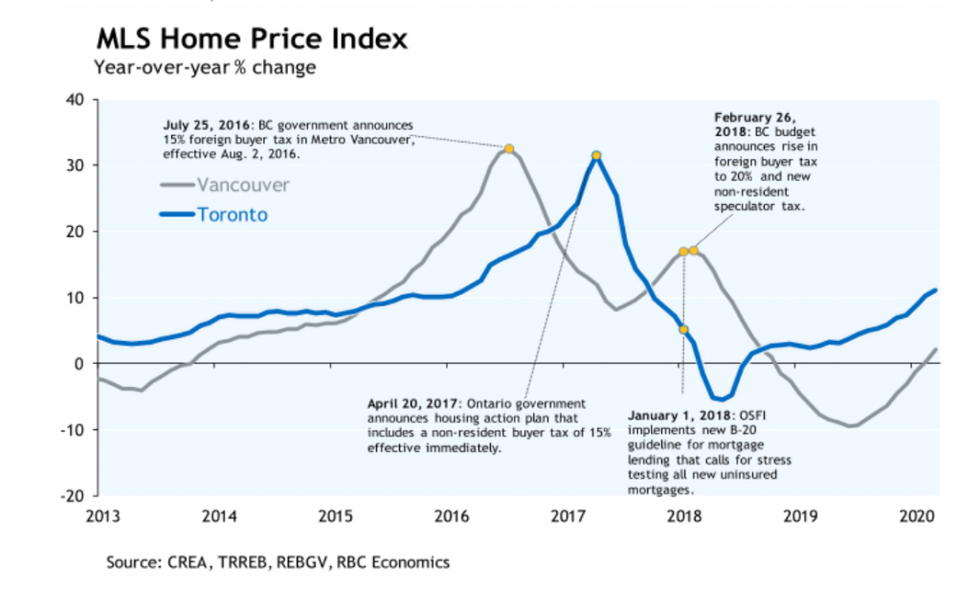

RBC bank analyst Robert Hogue says while home prices in Toronto strengthened in March, it's unclear how long this will continue. Hogue says RBC expects property values will come under increasing downward pressure the longer restrictions persist and the deeper the recession gets.

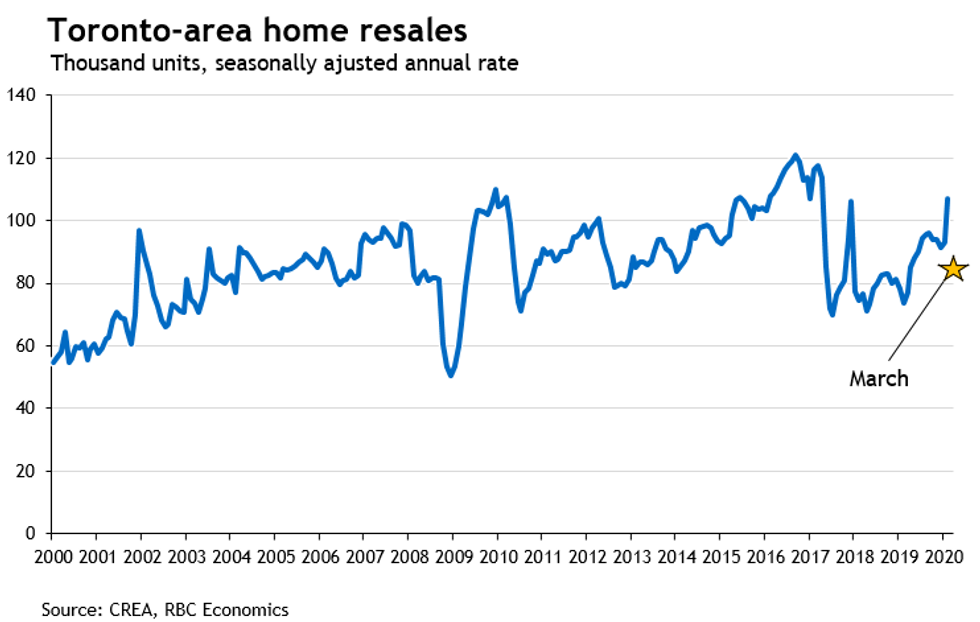

In March, Toronto-area home resales were up 49% year-over-year during the first two weeks of the month before plummeting 16% for the final two weeks.

Looking at the entire month, home resales in the Toronto-area were 12% above the level they were at a year ago, marking a significant slow down from the 44% year-over-year increase recorded in February.

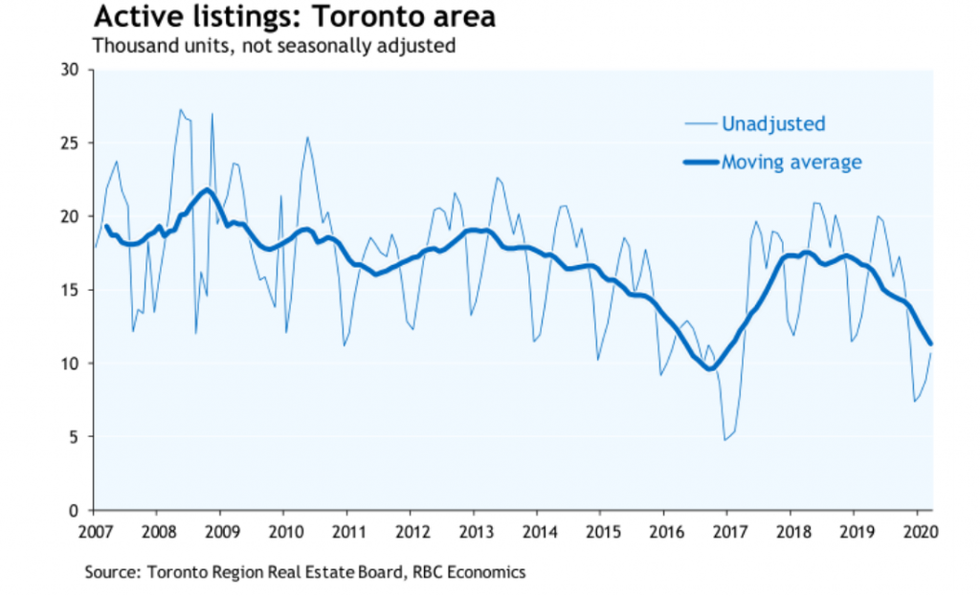

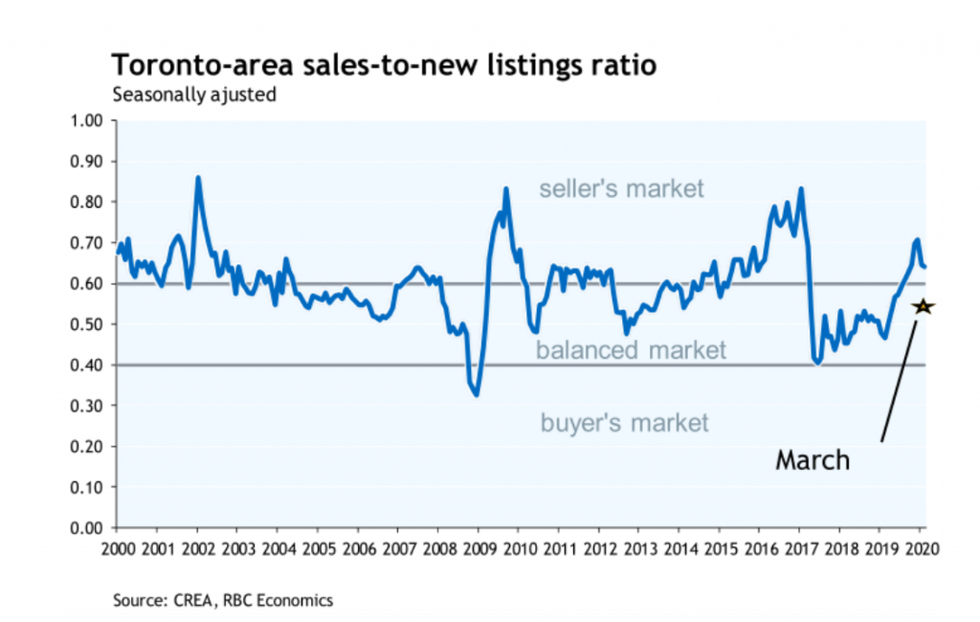

According to RBC, March activity shrunk roughly 23% from February on a seasonally-adjusted basis, while new listings fell 9%. Demand-supply conditions also loosened somewhat as a result, while remaining in balanced territory for the month, which RBC says maintained support for prices. Furthermore, RBC says the rate of increase in the MLS Home Price Index accelerated to 11.1% year-over-year.

Hogue says while he expects housing price support to wear down in the weeks ahead, RBC sees a "low risk" of a market collapse – at this point.

"We believe the extraordinary policy response from all levels of government and the Bank of Canada, as well as accommodating measures offered by financial institutions, will soften the blow."