When it comes to housing in Toronto, the city tends to have more homes built within the downtown core where people can walk or ride to work or in the outer suburbs for those who drive to work. Subsequently, there's a lack of homes being built for those who rely on public transit and live near transit lines, according to a new housing market insight report from the Canada Mortgage and Housing Corporation (CMHC)

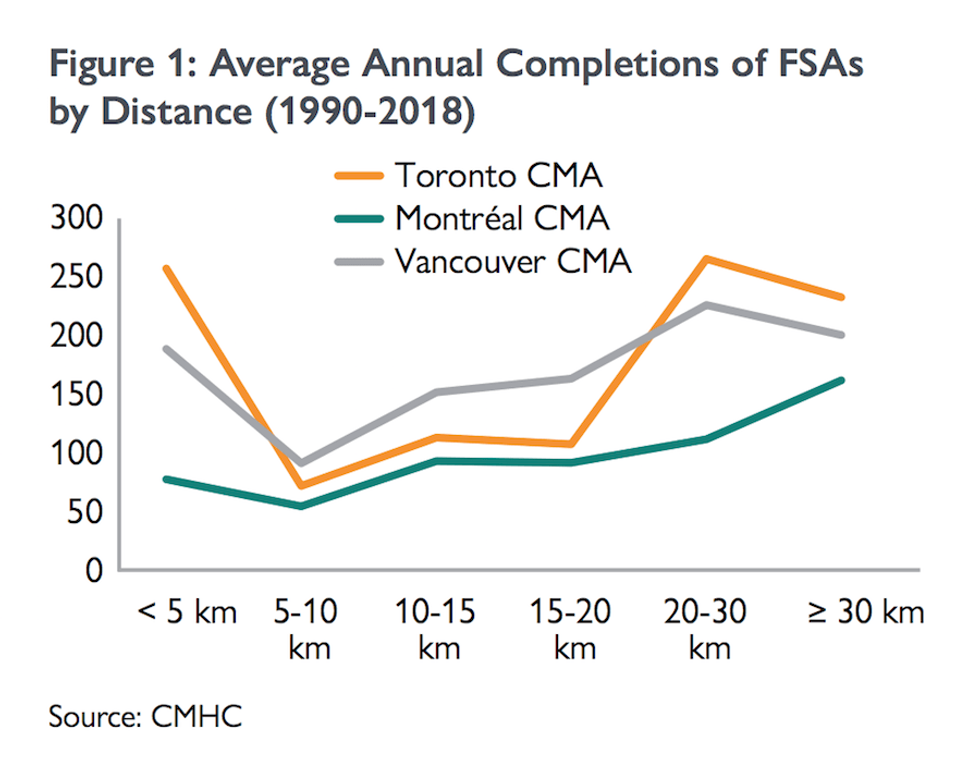

The report describes patterns of housing development in different locations within the three largest Canadian CMAs --Toronto, Montreal, and Vancouver -- from 1990 to 2018 and provides an overview of how much housing is being built relative to distance from the city centre.

“Outside the downtown areas of the major CMAs, housing starts are mainly increasing with the distance from the city centre because lots are available and cheap," says Mbea Bell, Senior Analyst, Economics. "This suburbanization leads to external costs that may affect the efficiency of housing policies in the long run.”

READ: 18 Canadian Markets with Home Prices Still Below the Current Average

The CMHC said it looked at three different areas, including the active core, which is where people walk or cycle to get to work where housing supply is mainly supported by condominium apartments.

Next is the transit suburbs, which are housing areas typically built around subway stations, where residents commute using public transportation. Housing supply here has been encouraged by transit-oriented development.

And finally, the auto suburbs, which is mainly comprised of single-family homes, with housing supply naturally fuelled by the availability and the low cost of land.

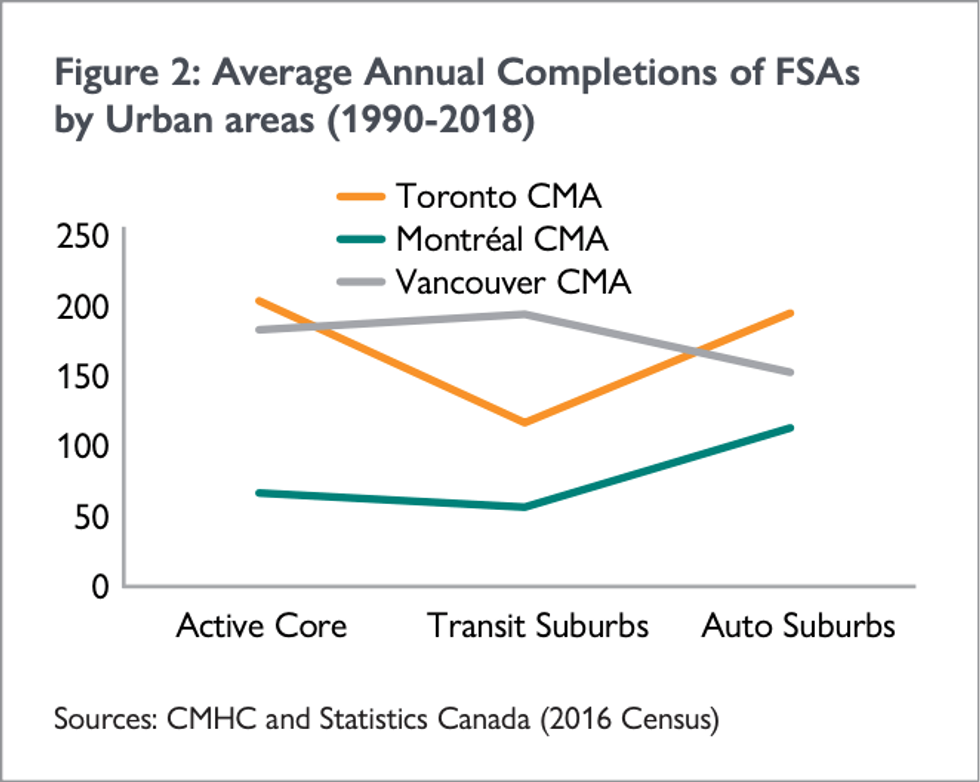

As you can see in the graph below, Toronto has a high level of average annual completions in the active core, its lowest level of completions in the transit suburbs, and then completions pick back up in the auto suburbs.

According to the CMHC, Toronto builds a high volume of housing, mostly condominiums and apartments, within five kilometres from the city centre. However, housing starts to decline to their lowest levels in the areas five to 10 kilometres away from the centre near public transit lines, then slightly rises in the 10- to- 20-kilometre areas.

The report also pointed out another interesting pattern that's apparent in Toronto and Vancouver, which is the relatively low level of construction in the wealthiest areas. This is likely due to municipal rules and "not-in-my-backyard opposition,” which may have constrained housing supply.

In comparison, Montreal has seen the lowest level of construction in its lower-income areas. This may be explained by the desire of middle- and high-income families to buy bigger homes off the Island, which leads to a high rate of renters (with lower income) in central areas.

Based on the research, the CMHC says the results indicate a strong pattern for suburbanization in Montréal, where the level of housing completions increases with distance from the city centre, and the new housing supply level peaks in the auto suburbs.

Similar to Montréal, Toronto has experienced urban sprawl with a high level of housing development in remote suburbs. However, Toronto has also seen a boom in housing construction in its active core. CMHC says urban sprawl is more limited in Vancouver, as the BC metropolitan area has a relatively stable level of construction in its urban areas.