The perfect storm of circumstances has descended upon Toronto and, as a result, the city's new rental listings saw growth of nearly 50% last quarter.

This is according to a new report from Zoocasa, wherein the immediate economic impact of COVID-19, social distancing, border closures, and restrictions surrounding schools, workplaces, and businesses are credited with a "domino effect" on the rental market.

For years, Toronto’s rental market has been known by its decade-low vacancy rates, high demand, and limited (available) supply. Due to the combination of circumstances revolving around coronavirus, however, those tables have turned.

“Previously, it was rather difficult and competitive for renters to attain their desired unit, particularly in the downtown area,” says Andrew Kim, a Zoocasa agent who specializes in the city's rental market.

According to Kim, in March and April -- when the pandemic was still in its early days in Toronto -- many renters, unsure about the ways COVID-19 would impact their jobs and lives, chose to terminate their leases to seek out better affordability, live closer to family, or find more space.

Kim isn't alone in noting the very tangible impacts the beginning of the pandemic had on local renters. According to a July rent report from Rentals.ca and Bullpen Research & Consulting, the average price for condominium apartments in the downtown core listed on the site is $2,444 — that’s down 22.2% year-over-year. That report implies that COVID-19 impacted renter behaviour; with more people working from home, proximity to work becomes a lesser priority, and downtown Toronto becomes less valuable.

And it isn't just the moves (or lack thereof) of Torontonians that impact the local market. New data from the federal government has revealed that immigration has plunged by nearly two thirds in the second quarter of 2020 as border restrictions remained in effect. Only 34,260 permanent residents were granted permission to enter the country between April and the end of June, compared to 94,275 in the same period last year; that's a staggering 64% drop.

READ: Canadian Immigration Down 64% Annually During Q2-2020

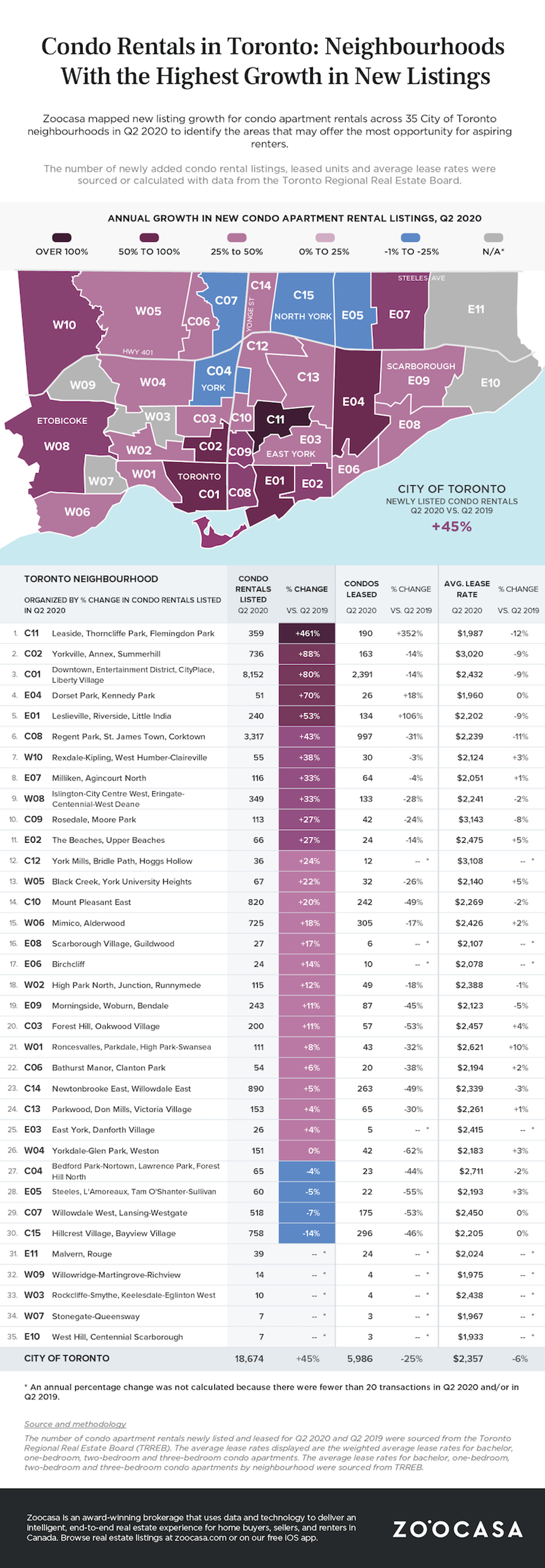

Zoocasa's new report reviews quarterly data from the Toronto Regional Real Estate Board (TRREB), ultimately providing a highlight on how condo apartment rental listing and lease rate trends have shifted across Toronto’s various neighbourhoods as a result of the pandemic. According to the report's findings, most areas throughout the city experienced an increase in the number of rental listings added, while the number of leased units dropped.

Overall, condo rental listings for the City of Toronto grew 45% year-over-year in the second quarter of 2020; growth was noted in 26 neighbourhoods. For the same period, the number of condos leased declined 25%, and growth in this area was only noted in three neighbourhoods.

With the city average as a reference-point, five neighbourhoods noted faster growth. The C01 (Downtown, Entertainment District, CityPlace, and Liberty Village) neighbourhood, for example, popular for short-term rentals, saw listings rise 80% y-o-y, while condo leases saw a 14% y-o-y decline in Q2.

Where the aforementioned three-neighbourhood annual increase is concerned, Zoocasa agent Jim Roberts says two of these may have had little to do with the pandemic at all. Neighbourhoods like C11 (Leaside, Thorncliffe Park, Flemingdon Park) and E01 (Leslieville, Riverside, Little India) saw a supply surge due to occupancy beginning at a few brand-new buildings. In C11, new listings rose 461% y-o-y in Q2 while new condo leases increased 352%, according to Roberts.

New rental listings increased 53% in E01 during the same period, and new leases increased 106%, making the neighbourhood the only one where the rate of new leases outpaced the growth in new listings.

For the city as a whole, average rental prices dipped 6% to $2,357. Those seeking Toronto's most affordable options would find them in C11 and E04 (Dorset Park, Kennedy Park, where average rental prices declined 12% y-o-y to $1,987, and remained stable at $1,960, also y-o-y, respectively. On the other end of the spectrum, despite respective 9% and 8% drops in annual rental prices, C02 (Yorkville, Annex, Summerhill) and C09 (Rosedale, Moore Park), maintained average rental prices above $3,000, at $3,020 and $3,143.

Where pure growth is concerned, the five neighbourhoods with the highest condo rental new listings growth for Q2 include:

- C11 (Leaside, Thorncliffe Park, Flemingdon Park) with 359 condo rentals listed (+461%)

- C02 (Yorkville, Annex, Summerhill) with 736 condo rentals listed (+88%)

- C01 (Downtown, Entertainment District, CityPlace, Liberty Village) with 8,152 condo rentals listed (+80%)

- E04 (Dorset Park, Kennedy Park) with 51 condo rentals listed (+70%)

- E01 (Leslieville, Riverside, Little India) with 240 condo rentals listed (+53%)

On top of the rental market's softening, many landlords and developers have opted to incentivize their options, which means would-be-tenants can snag goodies including free months of rent, bonuses, free parking spaces, and more. Sure, some circumstances suggest now may not be an ideal time to move house... but those looking to 'rent up' should deeply consider their options. "Masks in the moving van" sounds much less daunting when major savings are on the table.