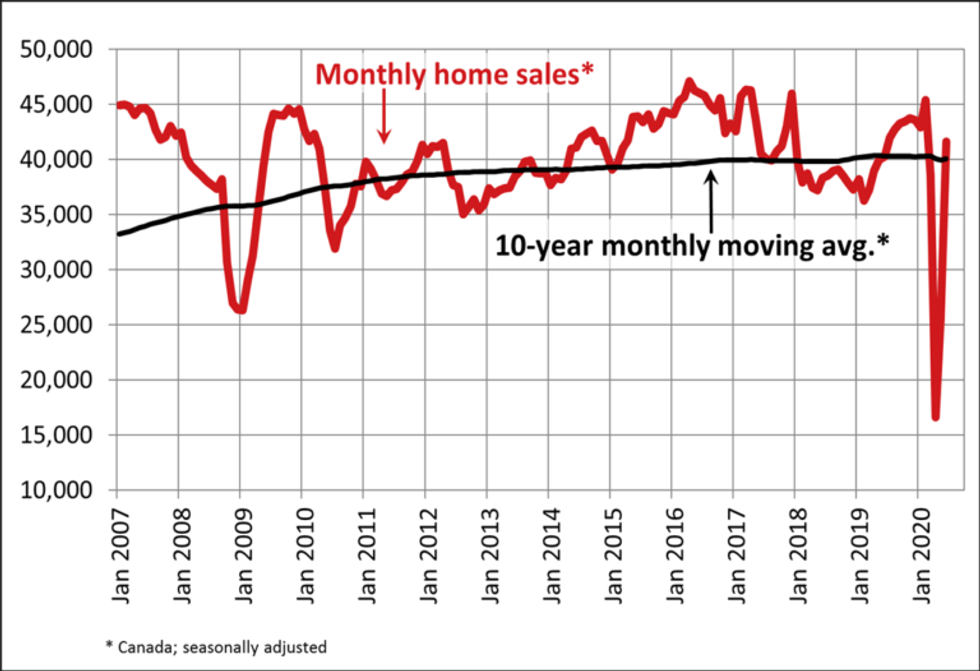

As the country continues to gradually reopen and begin what will surely be a long recovery from the ramifications of the COVID-19 pandemic, new data from the Canadian Real Estate Association (CREA) reveals that national home sales and new listings rebounded harder than Dennis Rodman in June. (The Last Dance, anyone?)

READ: New Home Builds in Canada Begin to Surge Again in June

Transactions were also up on a month-over-month basis across the country, with Canada's largest markets showing the biggest gains. Here in the Greater Toronto Area (GTA), sales were up an impressive 83.8%, followed by Montreal (75.1%), Greater Vancouver (60.3%), Edmonton (59%), Ottawa (55.6%), Calgary (54.9%), and Quebec City (43.6%). What is interesting to note is the Fraser Valley in BC saw the largest sales increase of 99.7%.

Costa Poulopoulos, Chair of CREA, says realtors across the country are now increasingly starting to see their business pick back up.

“With sellers and buyers returning to the market, we continue to make sure clients stay safe by complying with government and health officials’ directives and advice, increasingly using technology to list and show properties virtually while providing secure methods to complete required forms and contracts. As always, but maybe now more than ever, realtors remain the best source for information and guidance when negotiating the sale or purchase of a home,” continued Poulopoulos.

Shaun Cathcart, CREA’s Senior Economist, says that while June’s housing numbers were mostly back at normal levels, things are "obviously not back to normal at this point.”

“I guess the bigger picture is one of cautious optimism. The market has recovered much faster than many would have thought, but what happens later this year remains a big question mark."

That said, Cathcart says daily tracking suggests that July, at least, "will be even stronger."

The number of newly listed homes also increased in June, climbing another 49.5% compared to May. As with sales activity, gains were recorded across the country.

The national sales-to-new listings ratio tightened to 63.7% in June compared to 58.5% posted in May. According to CREA, the number of months of inventory is another important measure of the balance between sales and the supply of listings as it represents how long it would take to liquidate current inventories at the current rate of sales activity.

However, there were only 3.6 months of inventory on a national basis at the end of June – a 16-year low for this measure.

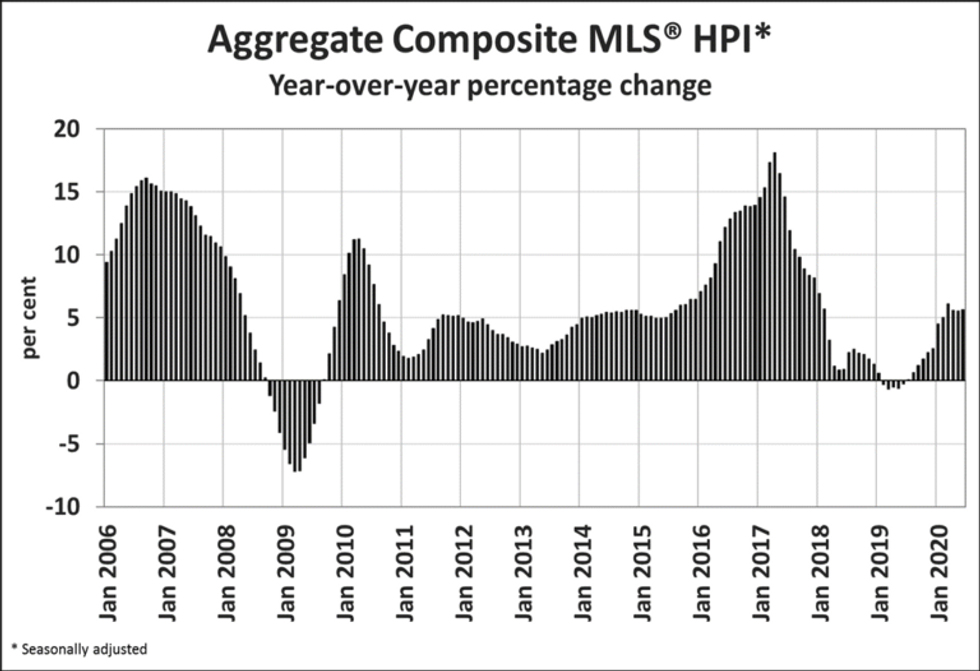

What's more, the aggregate composite MLS home price index climbed 0.5% in June 2020 compared to May. Of the 20 markets currently tracked by the index, 17 posted month-over-month gains in June. Based on the aggregate composite MLS home price index, CREA says prices are re-accelerating east of Manitoba with the exception of Toronto, while BC prices are also picking up with the exception of Vancouver. At the same time, home prices are declining in Calgary, while elsewhere on the Prairies prices are either flat or rising. The non-seasonally adjusted Aggregate Composite MLS HPI was up 5.4% on a year-over-year basis in June.

The actual (not seasonally adjusted) national average price for homes sold in June was almost $539,000, up 6.5% from the same time last year.

CREA says the national average price was heavily influenced by sales in the Greater Vancouver and the GTA, two of Canada’s most active and expensive housing markets. Excluding these two markets from calculations cuts more than $107,000 from the national average price.

Looking ahead, the extent to which sales fluctuate in these two markets relative to others could have large compositional effects on the national average price, both up and down.