Now might be the perfect time to refinance your home or apply for a mortgage because HSBC is currently offering rates below 1% for some mortgages.

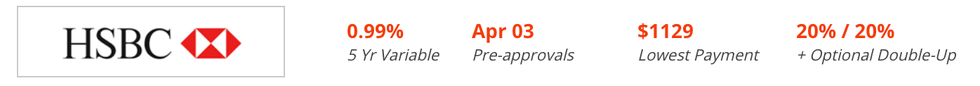

The bank is currently advertising a 0.99% rate on its website for new five-year variable closed term mortgages, with the annual percentage rate (APR), based on a $200,000 mortgage.

Previously, HSBC -- which is Canada's seventh-largest bank by assets -- was offering a rate of 1.44% for mortgages of this kind.

The deal only applies to high-ratio residential mortgages, which means the homebuyer has a down payment of less than 20% of the purchase price, with the lowest payment being $1,129.

According to Rate Spy, a higher interest rate may still apply for non-owner-occupied properties, amortizations greater than 25 years, and exceptions to HSBC's standard lending guidelines. However, the actual rate will vary depending on fluctuations to HSBC Prime Rate.

READ: Million-Dollar Mortgages in Toronto the New Norm Amid Pandemic: Report

The rate is only available in the following provinces: Alberta, British Columbia, Newfoundland, Nova Scotia, Ontario, Quebec, and Saskatchewan.

Currently, mortgage rates in the country remain low as a result of the Bank of Canada dropping its overnight rate amid the COVID-19 economic downturn. As a result, CMHC said about $1 billion worth of mortgage payments were deferred each month during the pandemic. According to CMHC, most of those deferral programs were for six months at most, meaning those who applied early will need to start making up those payments soon.

In June, HSBC lowered its five-year fixed mortgage rate to 1.99%, becoming the first bank to “crack” the 2% barrier.

This comes as mortgages in Toronto are now sitting in the $1-3 million dollar range, according to the latest mortgage trends report from LowestRates.ca.

“A combination of CERB, record-low mortgage rates, and remote work are pushing the housing market to new heights,” says Justin Thouin, founder and CEO of LowestRates.ca. “People aren’t spending on commutes, or going out. The savings is currently at a level we haven’t seen since the 1960s. And many people are funnelling those savings into housing.”

The Bank of Canada’s decision to buy mortgage-backed bonds also contributed, driving down mortgage interest rates and keeping demand for mortgages high.