September was a hot month for real estate in Canada, as home prices from coast to coast increased to the second-highest level for the month in 22 years, according to a home price index that monitors the country's housing market.

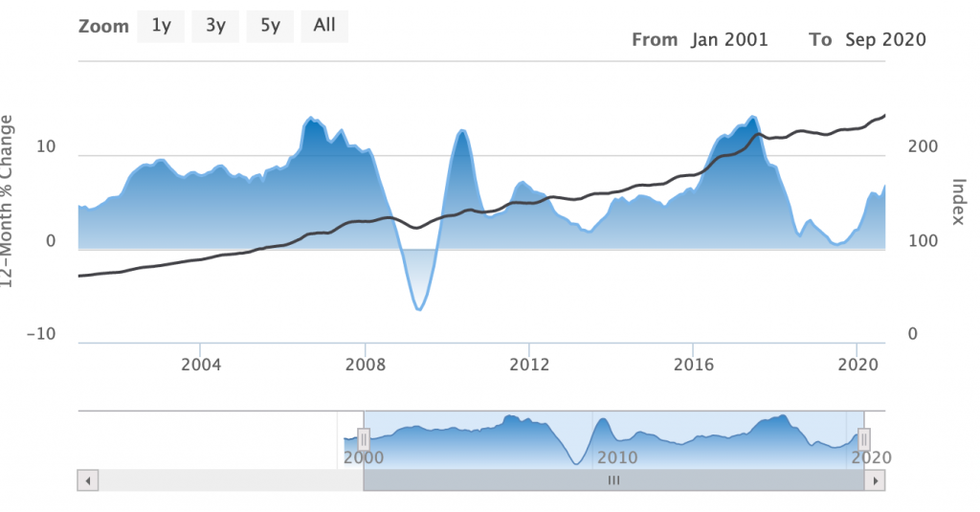

The Teranet-National Bank House Price Index -- which is based on the repeat-sales method (on the change in price between the two most recent sales of properties that have been sold at least twice) -- rose 1.1% from the previous month, the second-biggest gain for the month of September in the 22 years of the composite index.

The rise was led by Ottawa-Gatineau (2.3%), Quebec City (2.2%), Montreal (1.9%), Hamilton (1.9%), Edmonton (1.6%), Toronto (1.0%), Halifax (1.0%), and Vancouver (0.6%). There were also respectable monthly increases for Winnipeg (0.4%) and Victoria (0.3%), while Calgary edged up just 0.1%.

READ: Royal LePage Now Forecasting GTA Home Prices to Rise 8.5% by End of 2020

What's more, the September composite index was up 6.7% from a year earlier, an acceleration from August. The 12-month gain was once again led by Ottawa-Gatineau (14.3%), Halifax (12.2%), Montreal (11.1%), Hamilton (10.4%) and Toronto (8.3%).

Lagging the countrywide average were Quebec City (5.4%), Vancouver (4.4%), Victoria (3.9%) and Winnipeg (3.1%). Down from 12 months earlier were Edmonton (−0.8%), and Calgary (−2.6%).

Besides the Toronto and Hamilton indexes included in the countrywide composite, indexes also exist for seven other urban areas of the Golden Horseshoe – Barrie, Guelph, Brantford, Kitchener, St. Catharines, Oshawa, and Peterborough. All seven of these indexes were up from the previous month and from a year earlier. The 12-month gains ranged from 6.8% for Guelph to 14.2% for Brantford.

According to the report, the indexes for all of the 31 metropolitan markets surveyed were up in the month in September, marking the first month of across-the-board monthly gains in the whole period for which we have indexes for each of these 31 markets, since 2009.

The record gains come as economists continue to conflict over the outlook of Canadian home prices. This includes the Canadian Mortgage and Housing Corporation’s (CMHC) which previously forecasted for a 9-18% price drop -- a forecast that RE/MAX has previously referred to as “fear-mongering.”

To which, several Canadian economists recently said they don’t believe the Canadian property market will fall as far as what was initially forecast this year and that the prediction is “no longer relevant.”

Dominion Lending Centres chief economist Sherry Cooper said that the average home prices nationwide were up by 1.5% at the latest reading in August, cautioning that the CMHC is “overly pessimistic.”

Central 1 chief economist Helmut Pastrick echoed a similar statement and said that prices are “actually on the rise” and that record-low mortgage rates will continue to drive sales and prices higher.