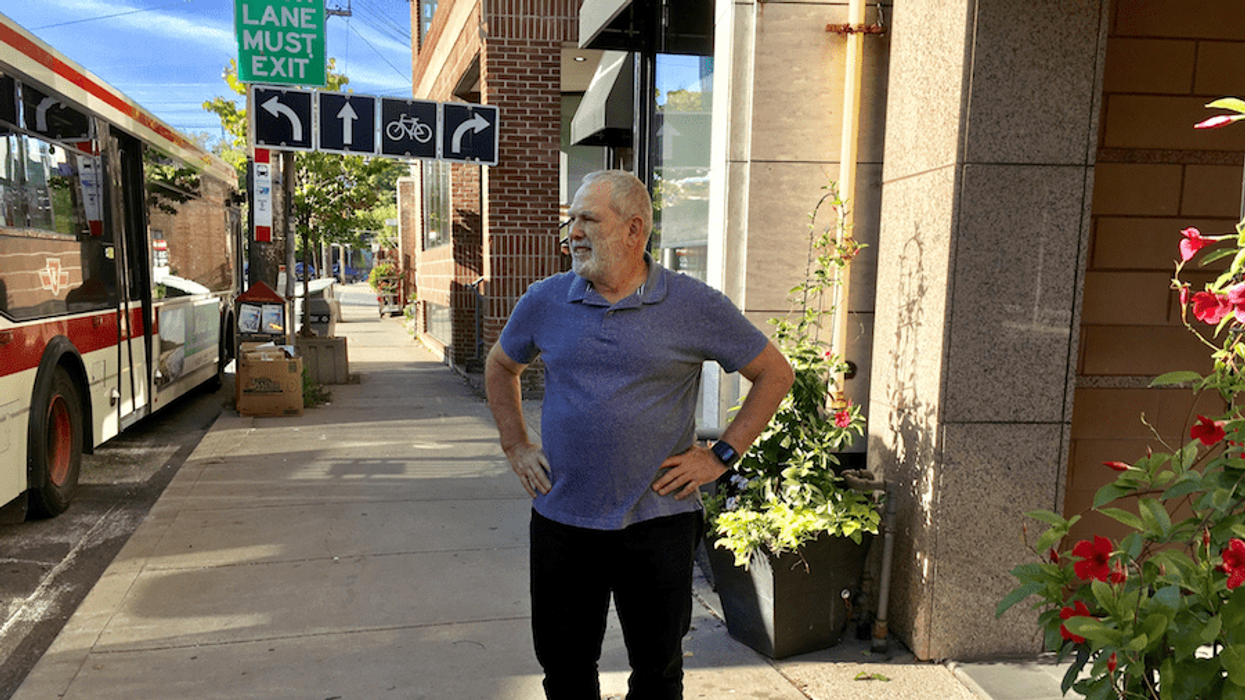

Henry Balaban has played a key role in the rise of Sutton Group, a Canadian real estate empire.

A franchise owner, he has been shepherding the Sutton Group-Associates Realty Brokerage Inc. and the agents within since 1993 to continued success and expansion. Balaban exercises his talents behind the scenes while his wife, Ophira Sutton (unrelated to the Sutton Group family), brokers real estate deals as a sales representative.

In a rare interview, Balaban details how wanting to spend time together led to the couple entering real estate, discusses the forces currently dictating the Toronto market, and explains that while the Ontario Government is now targeting foreign investors, it will never take aim at foreign money.

What initially got you into real estate?

I worked with my wife. We were renovating an old storage house in Cabbagetown. During the recession in 1981 we weren't getting enough business, so we agreed that my wife would go into real estate. After about half a year, I realized she was working 60, 70 or 80 hours a week and I worked 9 to 5 hours every week, so our lifestyles didn't jive. Both of us had a passion for renovation because we both had an arts background, so we both had a passion for design. But I decided to join her because we still had a passion for houses, but as a young couple real estate made more sense because we could spend more time together.

Where does your passion lie now and what keeps you in the real estate business?

Well, it's changed so much over the years. It started with a passion for houses and people who live in them, but since 1993, I am the broker now and I don't deal much with the public at all. However, I do have a great connection with agents. I really, really like to work with them, to help them create a career and I like to work with successful agents to help them mature in their business. Most agents are great people who are great to work with, so it's more the passion for the people in the business that drives me now.

So you're like a coach?

Maybe some people see it as a coach. I don't necessarily want to be there every day telling them how to do things. Just if they need assistance, I think I can help them create a vision or help put things in perspective for them to help them achieve what they want in the business and outside the business.

Did you work together with your wife?

We didn't really work together as agents. We worked together for a short while, then we worked separately. At one point in the early ’90s the market was very poor and I wanted to expand our business horizons. The opportunity to open a brokerage was presented and I haven't looked back since. It was a different path for growth for me and it has been a very great experience.

What are your impressions of the Toronto market today and is the real estate establishment and various levels of government doing enough to support it?

I don't know if the government should play a role. I don't know if they have a role and I think that trying to analyze the industry from the perspective of what the government is going to do in isolation from the other facets of society is impossible. We have a few forces that are working here that impact the market. I will get out my crystal ball and give you a projection.

First, the market currently is very strong. We are the only jurisdiction in North America where we can try to sell a house in the morning, list it in the afternoon and have it sold in the evening. This process would take three, four, five, or six months in other places. We also have lawyers and real estate agents who speak all types of different languages. When people bring foreign money here, they can deal with a lawyer and deal with an agent right away in a language they are comfortable with.

For that reason we will see a lot of real estate investment and what will fuel it is if interest rates will stay below five per cent, and if the demographic trends we can predict now will continue. Specifically, the baby boomers are going to leave their houses, they're going to scale down and their kids are getting to an age where they have kids and demand different housing styles.

This is really the biggest driver of the market. The demographics drive the market and the low interest fuels the interest. What puts the market into turbo mode is foreign money and I'm very careful not to say foreign investors because foreign investors are people. Foreign money is money that is not created by the economy here, it's coming from off-shore to invest into housing and small commercial property,

One mistake people make is that they place Toronto as one homogeneous market. Toronto is a market of neighbourhoods and there are some neighbourhoods with a shortage of product – put your house up for sale and you will get a very good price. Other neighbourhoods dissipate at a surprising rate, so you cannot take a broad brush and not take into account Toronto's neighbourhood factors.

What do you think of the rent control regulations that were recently implemented?

Let's remember one thing, I don't want to sound critical of the government. The government is trying to help. Unfortunately, they have very limited tools and they have a very limited understanding of what's going on. Every time you cool the market off, it's good for a buyer and it's bad for a seller. We have many people entering their golden years and they rely on the profit from a sale of a house — in which they lived for 40 to 50 years — for planning the later stages of their life.

There's no win-win, that's the problem. It's not better or worse when the market is higher or lower. The government took some steps to go after the foreign investor, but they're not going after the foreign money. There's a lot more foreign money than foreign investors and no foreign investor is going to touch down at Pearson Airport and say, “I am a foreign investor.” They will just give their money to a family member to invest because there are not many great places around the world where you can invest your money, and the Ontario Government is not adverse to foreign money.

I think you will continue to see a strong market, a shortage of product — particularly certain types of houses in desirable neighbourhoods, and the condo market will remain strong with a particular demand for more condos with multiple bedrooms geared towards families.