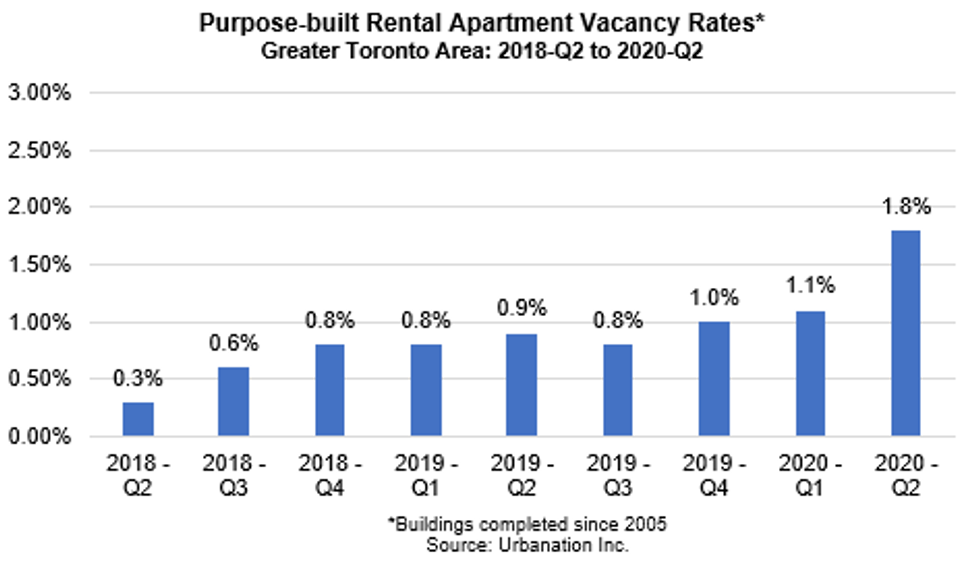

Vacancy rates for purpose-built rental apartments in the GTA have been gradually increasing over the past few years, reaching 1.8% in Q2-2020, all while rental construction remains at a near 40-year high, according to a new report from Urbanation.

The report, which was released Wednesday, focuses on Q2-2020 rental market results and revealed that the availability rate, which measures vacant units as well as units where the tenant has provided notice to vacate, also rose to 3.2%, a notable jump from 2.3% in Q1-2020 and 2.0% in Q2-2019.

What's more, Urbanation says both the vacancy and availability rates reached their highest levels since the real estate consulting firm began surveying the data in Q1-2015.

The City of Toronto led with the highest vacancy rates at 2.3%, compared to 2% in the outer 416 regions of Etobicoke, North York, and Scarborough. The 905 region saw vacancy rates of just 0.9%.

“The GTA rental market has been clearly impacted by COVID-19, though the transition has been orderly so far with vacancy remaining low and rent declines being modest outside of some specific pockets in the city," said Shaun Hildebrand, President of Urbanation."

Hildebrand added that government income support has played a "big role" as job losses mounted and immigration dropped.

READ: The ‘905’ is Now Outperforming Toronto-Area Housing Activity: Report

For the condo apartment buildings that have been completed for at least one year, average monthly rents for units that became available during Q2 declined by 3.7% year-over-year to $2,420, based on an average unit size of 751-square foot. Though it's worth noting that a recent report from Rentals.ca confirmed that average rents for 1-bedrooms of all types in Toronto have dropped by approximately $250 since January, to under $2,100 per month.

At the end of Q2-2020, the number of purpose-built rentals under construction in the GTA reached 13,358 units, remaining near its more than 40-year high that was previously reached in Q1-202o, when 13,580 units were built. This is also 17% higher than a year ago in Q2-2019 when 11,421 units were built. What's more, the former City of Toronto was home to close to two-thirds of rentals under construction.

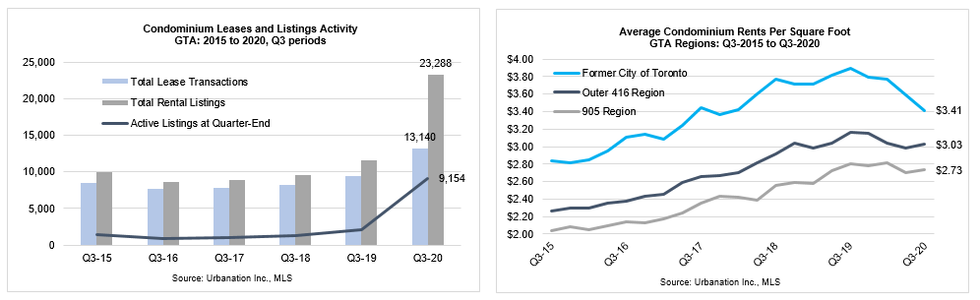

Urbanation found that condominium apartment lease activity for unfurnished, long-term rentals in registered buildings also declined notably year-over-year, falling 31% in Q2-2020 to 6,114 units. However, by June, as the GTA was entering into Stage 2 of the province’s economic reopening plan, lease activity during the month did rebound considerably, up 79% from the April low to come within 5% of its year-ago level in June 2019.

According to Urbanation, the lack of demand for rentals could be attributed to COVID-19, as condo rental supply surged to record highs. The total number of listings during the second quarter increased 22% year-over-year to 13,576 units, while active listings still available at the end of June more than tripled from a year ago to 6,757 units.

The lack of activity in the condo rental market led rents to decline by 3.6% year-over-year to $3.26 psf ($2,356 for 722 sf). However, the decline was almost entirely concentrated in the former City of Toronto, which saw a 6% annual decrease to $3.59 psf ($2,453 for 683 sf).

In the regions outside of Toronto, rents declined by 1.8% from a year ago to $3.02 psf ($2,285 for 756 sf), while in the 905 region rents held up best with a 1% year-over-year decline to $2.78 psf ($2,181 for 786 sf).

Urbanation says Toronto's strong rent decline may be a result of the "relatively less demand for more expensive rentals given the economic hardship and the expectation that work from home arrangements may become permanent, as well as a greater concentration of supply in the core due to rising condo completions and units formerly offered as short-term rentals."

What's more, Urbanation found that the number of furnished condo rental listings offered for 12-month leases, which grew 52% in Q2-2020 to 1,877 units, represented 12% of all condo rental listings in the GTA during the quarter and 21% of the growth in total condo rental listings compared to last year.

With demand for furnished long-term rentals declining in Q2-2020 (lease activity fell 24% year-over-year), average monthly rents for furnished units also dropped 12.5% from last year to $2,492.