In 1976, Hunter Milborne had his work cut out for him trying to convince people that spending $80,000 on a two-bedroom suite at 33 Harbour Square on the city’s waterfront was a sound investment.

Since then, Milborne, dubbed the “Dean of Condos” and his company, Milborne Real Estate, have played a key role in Toronto’s dramatic evolution into one of the world’s top condo markets. He’s sold more than 100,000 units and has been responsible for the marketing and sales of more than $25 billion in real estate.

With 2016 poised to go down in the books as the second-best year on record for condo sales with approximately 26,000 units sold, Milborne and his daughter, Amanda Milborne Ireland, a company director, predict another strong healthy year in 2017 and identify the key trends.

“So much of what we’re doing is driven by transit and 40 per cent of what has launched in the 10 years is within 500 metres of a transit stop,” says Milborne. “You’ve got your nodes at Bloor and Yonge and at Yonge and Eglinton, but Don Mills and Eglinton, and Bloor and Dundas are emerging nodes. Both will become transit hubs.”

New condo development has already started at Don Mills and Eglinton with Lindvest’s Sonic and its forthcoming second phase — and the nearby Celestica lands will become a large mixed-use community.

Another mixed-used project, Lower JCT from Castlepoint Numa and Greybrook Realty Partners, will be a game-changer in the Bloor-Dundas neighbourhood, housing the Museum of Contemporary Art Toronto Canada in an historic automotive building and providing new residences and community amenities such as a daycare and park.

Another key project to be launched in 2017 will be a 900-unit condo at Front and Sherbourne Sts. by Pemberton Group.

“If you want to make money in real estate, follow the artists,” says Milborne.

Foreign buyers will continue to represent a small but significant sector in the local market. Milborne says they represent approximately 5 per cent to 10 per cent of Toronto buyers. Milborne recently bought a stake in one of the United Arab Emirates top real estate companies, Gulf Sotheby’s International in Dubai. As Dubai is a major feeder point, along with China, for foreign buyers from countries such as India, Pakistan and Iran, he sees this as an effective way to attract more foreign buyers to the Toronto market, along with Canadian expats who are living there.

“In Dubai, when you buy a condo, you are paying a 30 to 70 per cent deposit and the first 10 per cent is non-refundable,” he explains. “When you look at Toronto, a foreign buyer can put a 35 per cent deposit in Canadian dollars and have 10 days to change his mind. There is definitely an appetite for condo investment and Toronto is becoming more and more attractive on the international level.”

Due to Brexit, London is no longer considered a desirable place to invest; and the election of Donald Trump has also frightened people away from the U.S. real estate market.

“International clients are not looking for a quick flip. Most want to rent their units out,” says Milborne Ireland. “They are in it to hold for the long term … they are going to be a growing segment of the market.”

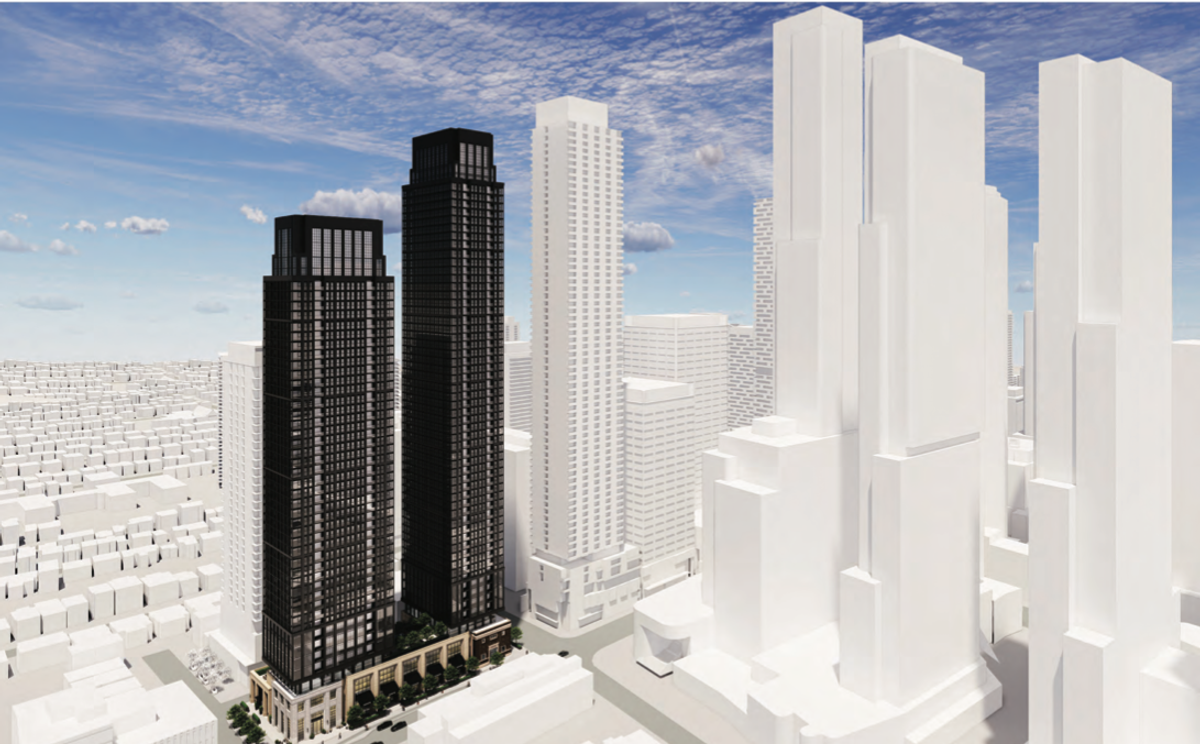

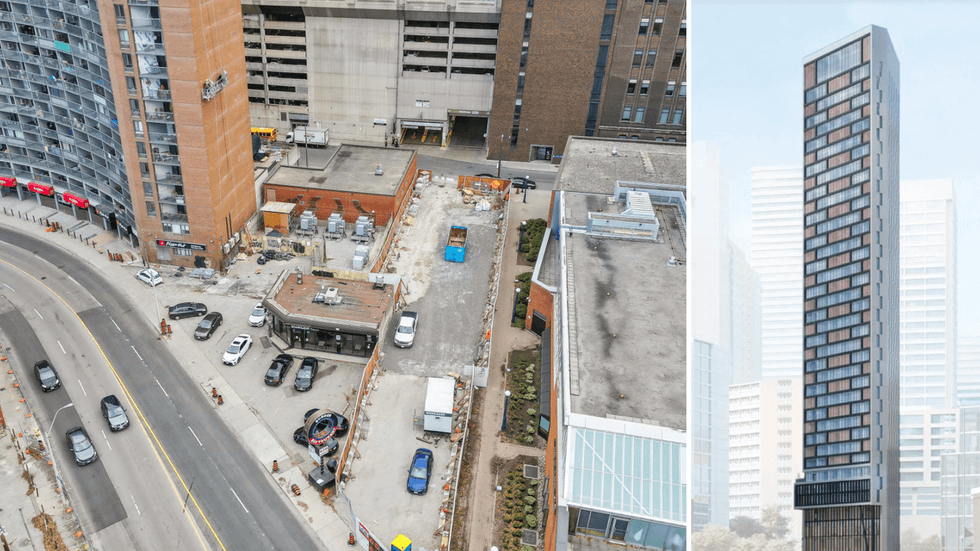

The Milbornes say other projects to watch for in 2017 include the final phase of River City from Urban Capital; the long-awaited Mirvish+Gehry skyscrapers in the Arts and Entertainment District; the first phase at Downsview Park from Mattamy Homes; and Mattamy’s Vita on the Lake in Etobicoke, as well as more launches at Central Park Ajax, a massive master-planned 905 development.

There are challenges ahead for developers, the Milbornes say.

“It’s becoming harder and harder to buy sites and get them approved, yet you have this relentless demand,” he says. “The supply might be constricted, even in highrise.”

His daughter points out that condo inventory is at an all-time low with 11,000 units, which is about half the 20,000 units deemed to be a healthy inventory in Toronto. That’s concerning when between 100,000 and 125,000 people move to the city each year from outside of Canada or from other parts of the country.

“About 80,000 people between ages 20 and 40 moved to Toronto from other parts of Ontario in 2016,” says Milborne Ireland.

That is going to make affordability a greater challenge in a city where prices are climbing. Milborne Ireland suggests Toronto should look at inclusionary housing policies that cities such as London and New York have adopted to provide affordable housing for the young working class.

She says, however, those types of solutions must come from policy makers, not developers.