“Simply put, the new rules aren’t a game-changer,” says Jerome Trail, owner and broker of record at The Mortgage Trail.

The rules Trail is talking about are the newly released changes the Canadian Mortgage Housing Corporation (CMHC) is making to its underwriting policies for insured mortgages. The changes, set to take effect on July 1, will apply to all new applications for homeowner transactional and portfolio mortgage insurance and include:

According to Trail, this could have a substantial impact if it weren't for the fact that Canada's other two mortgage insurers – Canada Guaranty and Genworth Canada – both of which have said they will not be following CMHC's lead and will instead be keeping their underwriting policies the same.

READ: Canada’s Mortgage Stress Test Good in Theory, But Should Be Better in Practice

Earlier this month, both Canada Guaranty and Genworth Canada released statements confirming that they would be maintaining their current policies, which are identical to CMHC's policies before the new changes take effect.

"Essentially, there will be no net effect made by CMHC's changes," Trail says.

When it comes to a traditional insured mortgage, the application is submitted to a lender who reviews for approval. Once the application is deemed worthy by the lender, it is then submitted to an insurer for approval. "Lenders will now simply bypass CMHC if they know that the application doesn't meet their new criteria and will instead submit to either Canada Guaranty and Genworth Canada,' explains Trail.

It's likely that the biggest change to come out of this will be CMHC's market share of insured mortgages, as any applications that find themselves falling between current underwriting policies and CMCH's new ones will now be submitted to one of the country's other two national insurers.

With millions of Canadians out of work, countless businesses being forced to close, and immigration down heavily in April, CMHC announced its upcoming changes with the intention to protect future homebuyers and reduce any future risks.

In May, CMHC CEO Evan Siddall said the housing corporation was now forecasting between a 9 and 18% drop in average house prices across the country over the next 12 months.

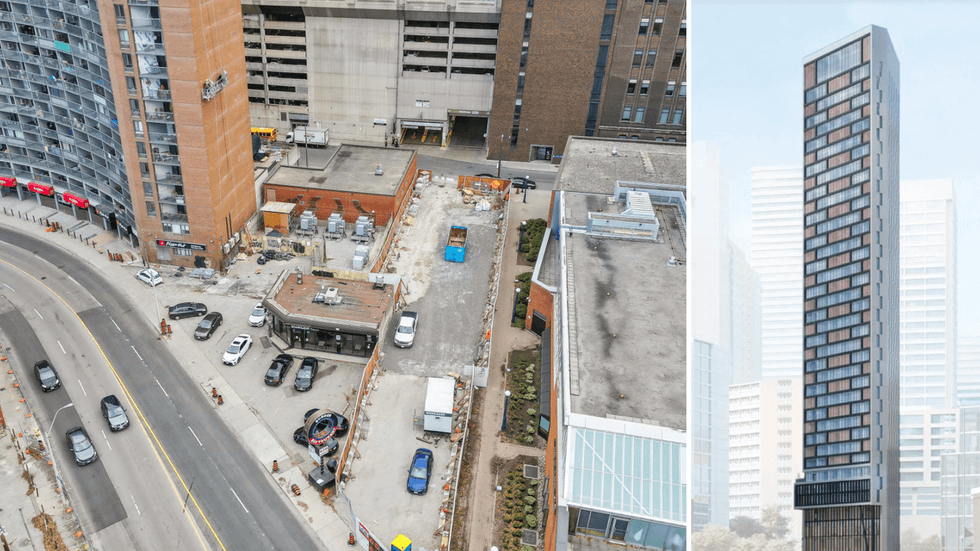

Despite this, the housing market both in Toronto, and nationally, remains highly competitive – and it doesn't look as if CMHC's policy updates are going to change that anytime soon.