Among the flurry of real estate forecasts being made in the worst weeks of the COVID pandemic, TD was one of the only predictors to take the plunge on housing prices going up in 2020 -- believing Toronto could see as much as 7.8% growth in 2020.

At the time, the end of April, many with interest in the market were aghast at the boldness of TD's claim. The only thing louder than the sound of jaws hitting the floor was the laughter coming from perpetual bubble bursters. The country was, after all, just six weeks into the greatest economic calamity since The Great Depression and housing sales were hitting historic lows.

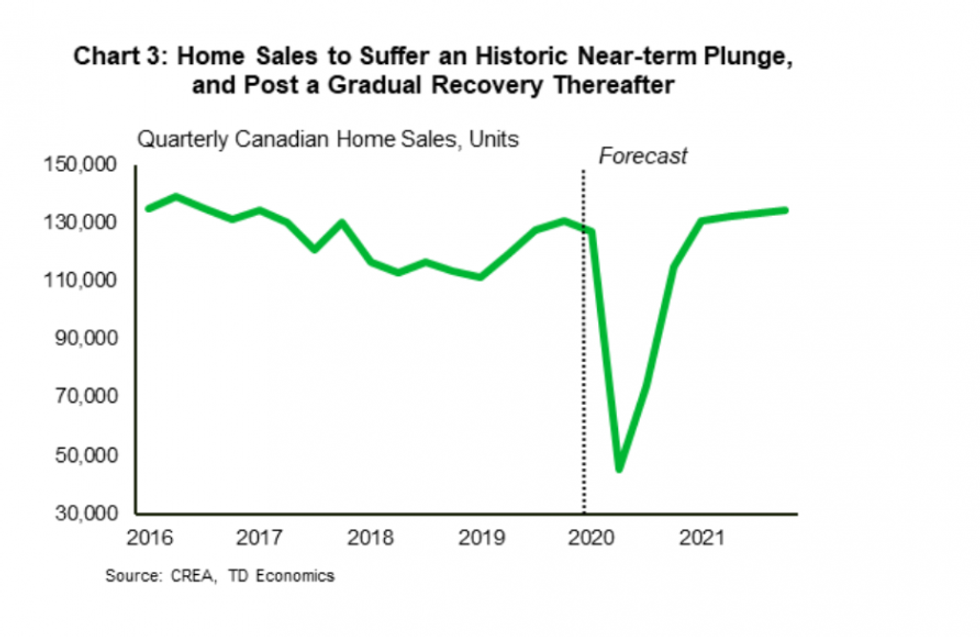

That's not to say TD didn't see what was happening, but what they did see led them to believe the Canadian housing market would follow this path:

Fast forward three-and-a-half months and, well, the only thing TD appears to have gotten wrong so far was just how quickly the market would recover and how high prices would soar once the economy reopened.

Locally, the Toronto market also smashed previous July sales records, while also setting a high-water mark for price, with the average home in the GTA (all home types) hitting $943,710. According to TRREB, average home prices in the GTA are now up 16.9% from a year ago -- nearly 10% higher than TD's April forecast suggested.

READ: Ask An Agent: Why Was July Such a Busy Month for Toronto Real Estate?

Nationally, July just posted the highest number of sales transactions for any month on record. New listings broke an all-time July record. The actual national average price for homes sold in July was a record of $571,500, up 14.3% from the same month last year. As Shaun Cathcart, CREA’s Senior Economist, put it, “What a difference three months makes, from some of the lowest housing numbers ever back in April to the multiple monthly records logged in July.”

Indeed.

As TD's latest report notes, "It looks like we got at least one "V" recovery after all. In just three short months, Canadian resale activity and average prices have not just popped back to above pre-pandemic levels, but to new record highs. With many markets extremely tight and the pandemic making a mockery of typical sales patterns, August is already shaping up to be another hot month."

So, while it doesn't seem as though the market has any intention of cooling off this summer, this is not to say it can't, and won't, be stopped. Immigration, a perennially important factor to keeping the Canadian housing market strong, was down a more-than-significant 64% year-over-year in Q2. The mortgage deferral period granted to many homeowners at the beginning of COVID will end within the next few weeks, a proposition so worrisome to the CMHC that they have openly referred to it as a 'cliff'. And CERB, the government relief program implemented to offset job loss during the pandemic, will also be coming to an end on September 26 (though, as TD notes, "The pandemic has disproportionately impacted lower income Canadians, who are less likely to be or become homeowners.").

As potential homebuyers have been forced to cancel vacations over the summer, they have more time, and possibly more income, to invest in the housing market. How long this interest can last, and just how much pent-up demand remains, is yet to be seen. TD ends its latest report with caution, noting it's "important not to extrapolate recent gains too far."

One thing's for sure though, just 12 weeks ago no one saw a rebound this robust coming this quickly. Let's just hope the next 12 weeks don't walk it all back.