Just when things were appearing cheerier for the Toronto real estate market, sales have dipped once again on a year-over-year basis. According to the Toronto Real Estate Board’s February report, activity was down 2.4 per cent from the same month in 2018 with a total of 5,025 homes sold, wiping out the modest gains seen in its January report. The board also indicates monthly sales are down from a seasonally-adjusted perspective.

Home prices, however, stayed fairly stable, increasing 1.6 per cent to an average of $780,397 throughout the TREB region. Homes within the City of Toronto specifically saw prices pick up a bit more, rising 4.1 per cent to $840,211, though the 416 also experienced a -6.6 per cent decline in sales.

Buyers Still Struggle with Supply Imbalance

The supply of new listings continued to shrink, which has kept the market in a fairly tight territory as the number of homes brought to market fell 6.2 per cent to 9,838 units. That’s effectively outpaced the slowdown in sales activity and has kept the TREB market balanced, with a sales-to-new-listings ratio of 51 per cent. The 416 hovered slightly closer to sellers’ conditions with a ratio of 56 per cent.

Less Expensive Home Types in Highest Demand

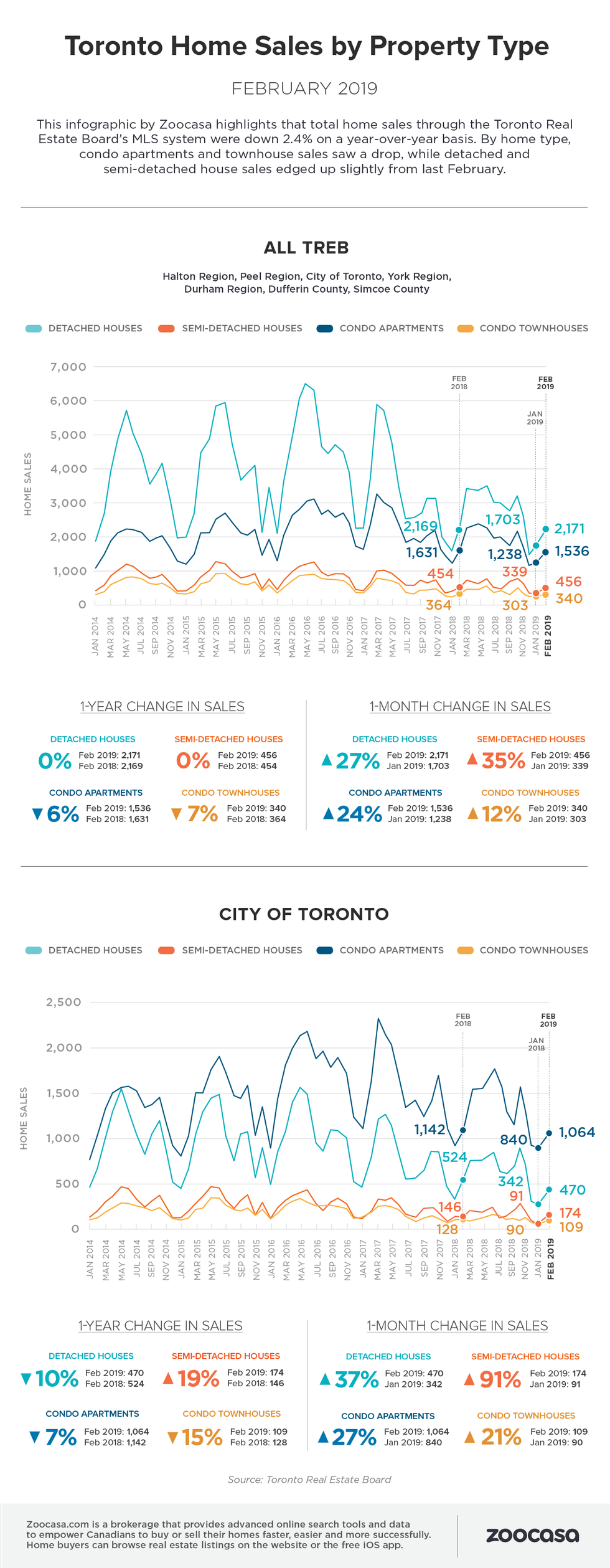

Condos continued to be a market leader in terms of price growth, while absorbing a 5.7 per cent decline in sales. The price of an average unit in the GTA rose 6.1 per cent to $562,161. In comparison, detached home prices remain nearly double that of their multi-family counterparts, despite falling -2.1 per cent to $980,914, and enjoying just a 0.8 per cent uptick in sales.

Townhouses saw sales fall -6 per cent at 793 units, softening the average price by 0.5 per cent to $635,693. Semi-detached house prices saw the greatest improvement, up 9.9 per cent to an average of $833,569. However, due to comparably overall lower inventory than other home types– just 456 units sold (+1.8 per cent) – trends for this segment can swing more dramatically.

READ: CMHC Plans To Have All Canadians In Affordable Homes By 2030

As is typical, trends varied across the GTA region depending on the mix of home type. Sales for the MLS Mississauga region, for example, rose 8.7 per cent, fueled by stable sales for more affordable Mississauga condos. Nearby Oakville, however, saw sales plummet by 29 per cent due to a larger proportion of higher-priced homes.

TREB Urges Feds to Consider Housing Affordability Measures

While the mid-winter market is typically the slowest – inclement weather is hardly ideal when planning an open house – TREB continues to point the finger at the infamous national stress test. Implemented in January of last year, it requires borrowers to qualify at a mortgage rate 2 per cent higher than the one they’re actually getting from their lender, which has reduced home purchasing power for many. That’s led to fewer homes in higher-price points sold, as more buyers turn to the condo market, or put their buying ambitions on hold altogether.

READ: TREB Calls For A Review Of Mortgage Stress Test As Home Prices Rise

“The OSFI-mandated stress test has left some buyers on the sidelines who have struggled to qualify for the type of home they want to buy,” stated TREB President Garry Bhaura in the board’s release.

TREB has also taken aim at the upcoming federal election, imploring the sitting government and prospective campaigners to consider home affordability measures as part of their platforms. The board has specifically recommended that maximum amortization periods be extended to 30 years from 25 for home buyers putting less than 20 per cent down. They’ve also pointed to the economic risks posed by letting too much steam out of the market due to aggressive policies.

READ: How To Save For A Down Payment In Toronto When You’re Single

“Home sales reported through TREB’s MLS® System have a substantial impact on the Canadian economy. A study conducted by Altus for TREB found that, on average, each home sale reported through TREB resulted in $68,000 in spin-off expenditures accruing to the economy,” stated Jason Mercer, TREB’s Director of Market Analysis and Service Channels.

“With sales substantially lower than the 2016 record peak over the last two years, we have experienced a hit to the economy in the billions of dollars, in the GTA alone. This hit has also translated into lower government revenues and, if sustained, could impact the employment picture as well.”

Check out the infographic below to see how TREB home sales by property type performed on an annual and monthly basis: