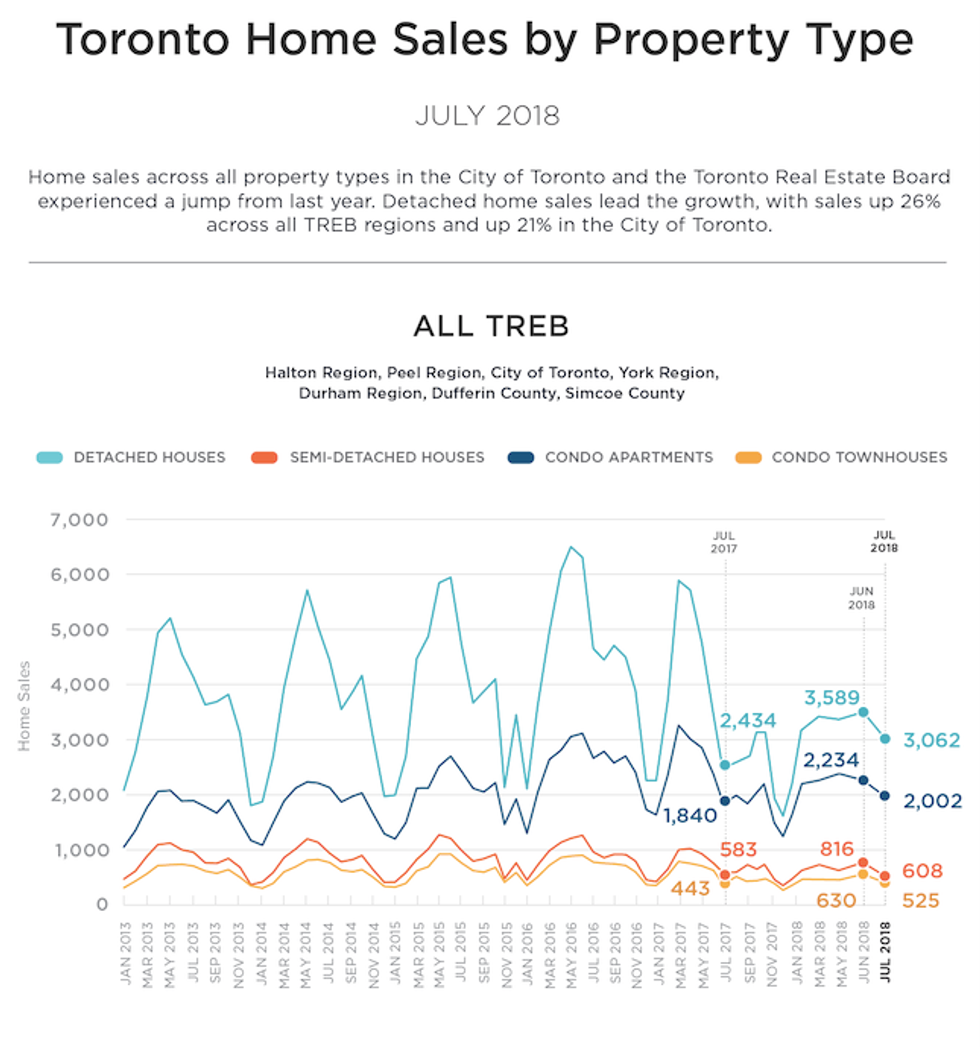

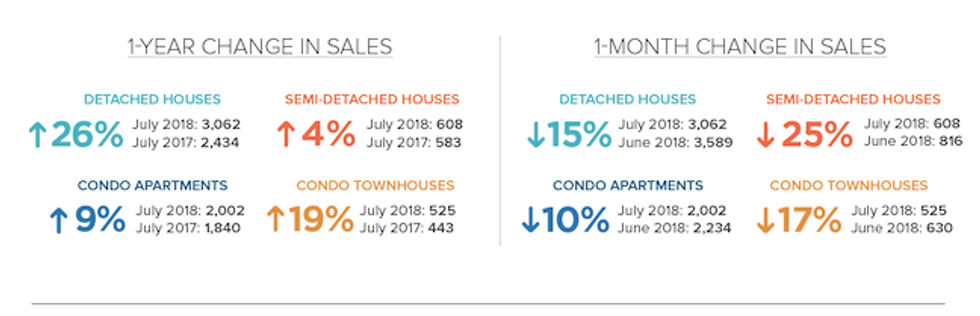

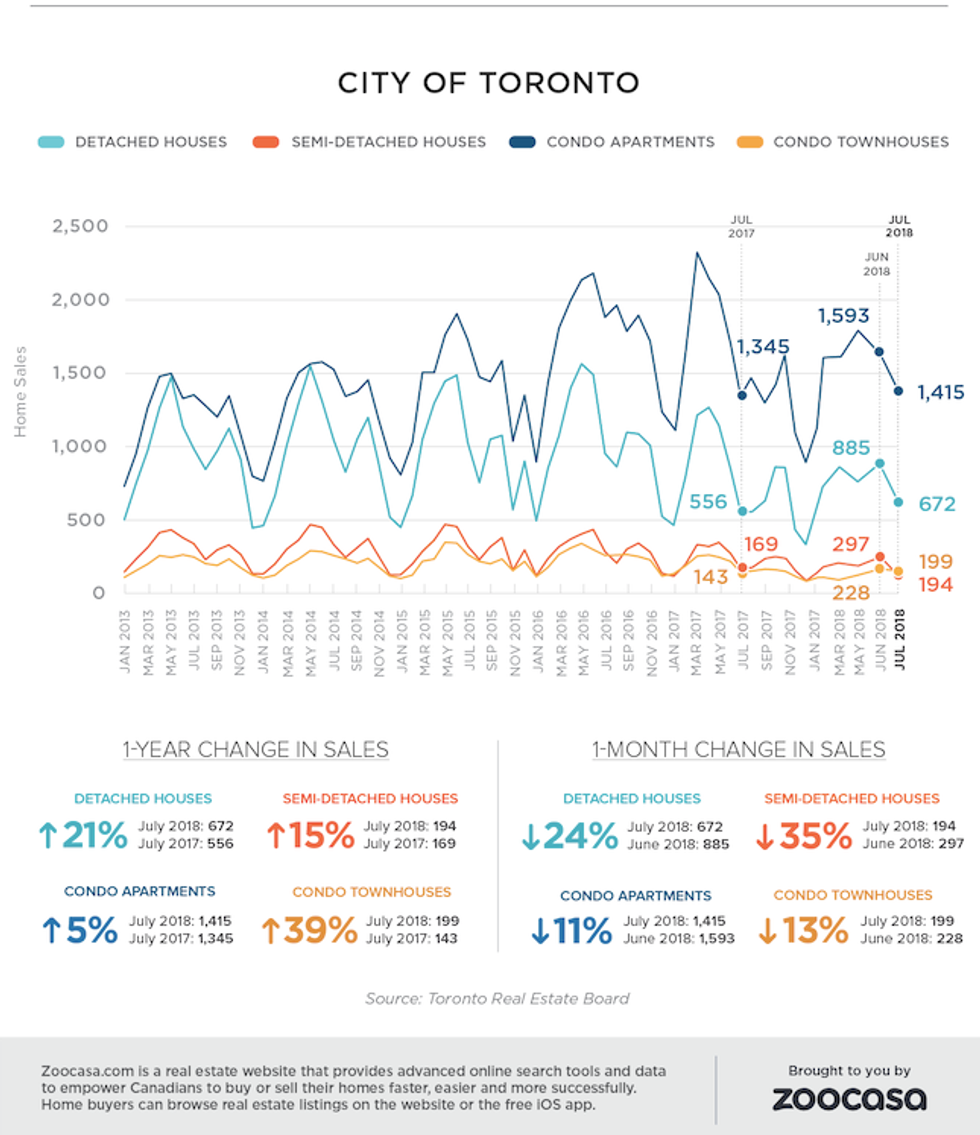

July has been an outstanding month for Toronto real estate, in a year which saw the first sustained downturn in well over a decade.

The average property price rose 4.8 per cent to $782,129 from July 2017 and sales increased 18.6 per cent across the Greater Toronto Area.

June to July saw the highest level of seasonally adjusted month-to-month data in 2018, with sales up 6.6 per cent and prices up 3.1 per cent.

READ: New Condo Sales Drop In Toronto And GTA, Developers React

“We have certainly experienced an increase in demand for ownership housing so far this summer,” said Jason Mercer, TREB’s director of market analysis.

What Cool-Down?

The downturn in the previous months of 2018, saw sales slow and even plunge in the double digits for all market types. It often had negative sales growth, for all market types — except condos. This, of course, was not due to natural market forces.

Instead, it was a direct result of interference by the Ontario Government through it’s Fair Housing Plan and by the bank regulators' new, tighter mortgage lending rules.

The express intention was to cool the market and reduce debt risk, after the runaway growth in early 2017.

READ: How Much You Need To Earn To Afford A Home In These GTA Cities

But this suppression of the market was always likely to be temporary, and largely due to buyer and seller uncertainty.

Ultimately, nothing has changed in the fundamentals: demand remains high and supply remains low.

“It appears that some people who initially moved to the sidelines due to the psychological impact of the Fair Housing Plan and changes to mortgage lending guidelines have re-entered the market,” says Mercer.

Supply Shortfall

Supply levels remain low due to multiple factors: greenbelt policies, Millennials coming of age, lack of suitable housing between a condo and a detached house for boomers and population growth in the GTA, just to name a few.

New listings are down 1.8 per cent from last year, and overall supply is near historic lows.

“The new provincial government and candidates for the upcoming municipal elections need to concentrate on policies focused on enhancing the supply of housing and reducing the upfront tax burden represented by land transfer taxes, province-wide and additionally in the City of Toronto,” says TREB president Garry Bhaura.

Condos Biggest OSFI winner

Although government and federal bank regulator policies could not hold down the overall GTA market for long, they did appear to have a marked effect on buyer behaviour.

Condos continue to show the fastest and strongest price growth across the board, up 8.9 per cent to $546,984 — the least expensive market segment.

READ: GTA Cities With The Highest And Lowest Property Taxes

It’s likely that buyers are now unable to borrow enough money to stretch them into a property on the ground.

Since January 1, prospective buyers must prove their income can support a mortgage at 5.34 per cent, or two percentage points higher than their contract rate.

Prices for detached houses, which have been trending negative all year in terms of growth from 2017, are finally up a tiny 0.5 per cent to $1,004,647. This is still out of reach of most Torontonians.

TREB is looking forward to the rest of the year and is confident in continued price and sales growth.