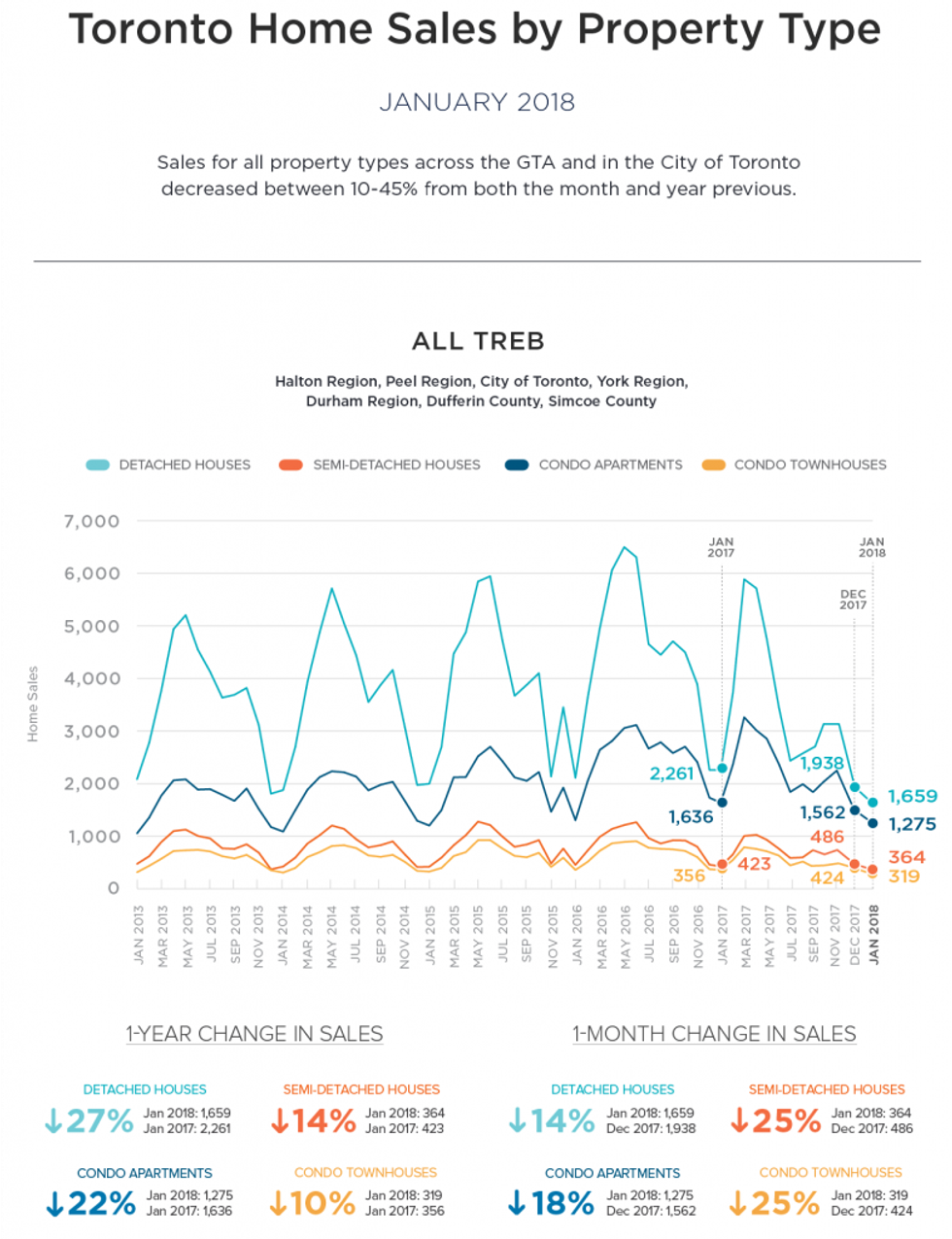

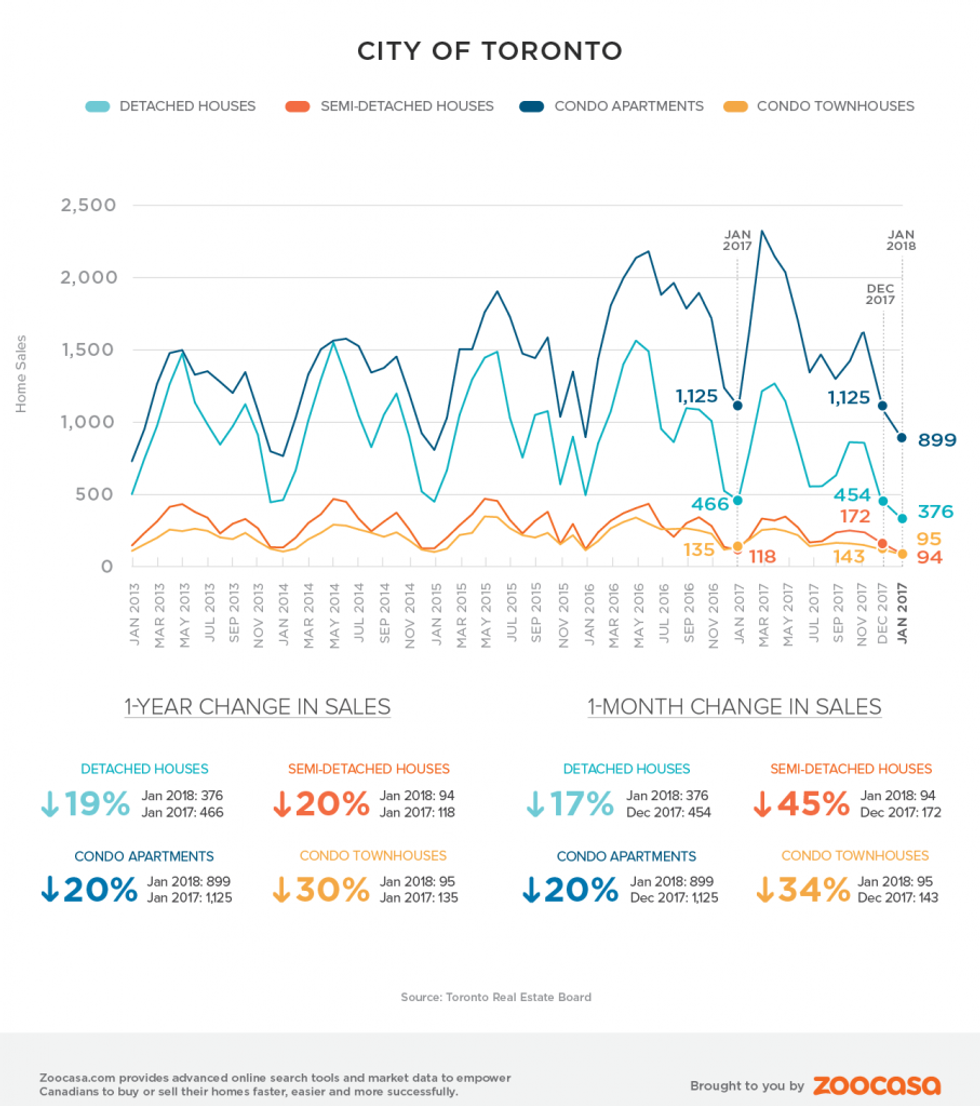

This year’s January real estate market is off to a substantially slower start than last, with sales plunging 22 per cent year over year — but experts say perspective is everything.

The latest report from the Toronto Real Estate Board (TREB) reveals 4,019 fewer homes changed hands, contributing to a 4.1-per-cent price drop to an average of $736,783 throughout the Greater Toronto Area. New listings, meanwhile, rose 17.4 per cent, planting the GTA firmly in balanced territory rather than the steep sellers’ market that governed real estate in the first half of 2017.

New rules take bite out of market

The data suggests numerous measures to cool the market have taken their toll. Last April the Ontario government introduced its Fair Housing Plan, which included a foreign buyer tax. New mortgage qualification rules and rising interest rates have also effectively contained home buyer demand.

Everything in perspective

While such declines may seem like cause for alarm, analysts are quick to point out the numbers are in comparison to last year’s record price growth, which had rapidly become unsustainable for most buyers.

“It’s important not to let year-over-year figures skew how we look at market conditions,” says Lauren Haw, Broker of Record at Zoocasa Realty.

“We know that sales are down from 2017’s abnormally high first-quarter levels. Sales are in-line with the hot 2016 market – when we saw headlines about the ‘continuous overheating’ market. It’s also important to focus on individual markets to see what is going on, in places like Peel, Halton and Durham Regions, as opposed to the TREB Region as a whole.”

Her sentiments are echoed by TREB’s director of market analysis Jason Mercer. He says the decline across most home types is in line with what the Board had predicted for early 2018.

“At this time last year, we were in the midst of a housing-price spike driven by exceptionally low inventory in the marketplace. It is likely that market conditions will support a return to positive price growth for many home types in the second half of 2018,” says Mercer.

Condos will continue to lead market

Mercer anticipates that, much like in the latter half of 2017, Toronto condos will continue to lead the market in terms of price growth and demand, as tougher mortgage hurdles knock buyers down the ladder of affordability. Condos were the only housing type to increase in value year-over-year last month, rising 15 per cent to an average price of $507,492. In comparison, prices for detached Toronto houses for sale plunged nine per cent to $970,823. Semi-detached and townhome prices each fell two per cent, to $715,784 and $519,936, respectively.