The 2018 Toronto housing market is off to a slow start, and buyers' market conditions prevail.

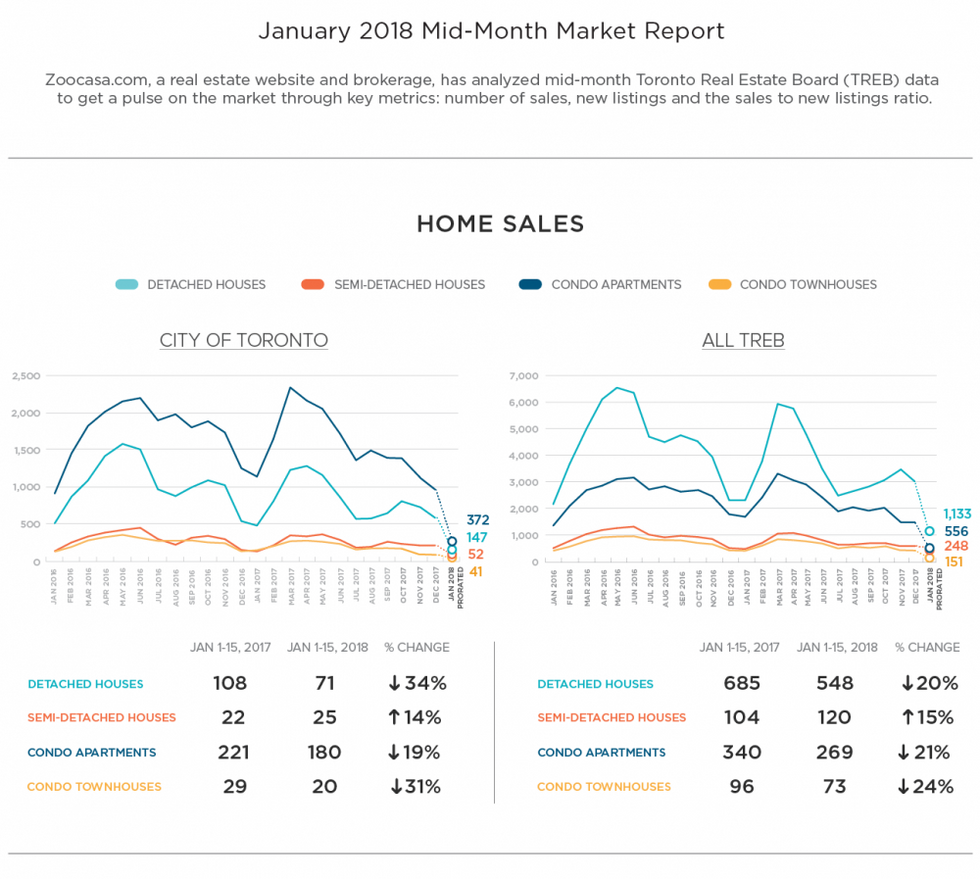

According to mid-month data collected by Zoocasa from the Toronto Real Estate Board (TREB), numbers indicate sales are down annually across every housing type — with the exception of semi-detached homes.

A number of factors could be influencing January real estate, which, so far, is in sharp contrast to the frantic activity witnessed in early 2017 when Toronto real estate ramped up towards the March peak. This year, buyers and sellers prove trepidatious as new mortgage rules — which have slashed affordability for the average buyer by 20 per cent — are absorbed.

The mid-month numbers compile sold data from the first two weeks of the month, providing a short-term pulse on market trends.

A quiet start for the condo market

While Toronto condos led the 2017 market in terms of demand and price growth, increasing in value an average of 23.1 per cent, activity has been tepid thus far.

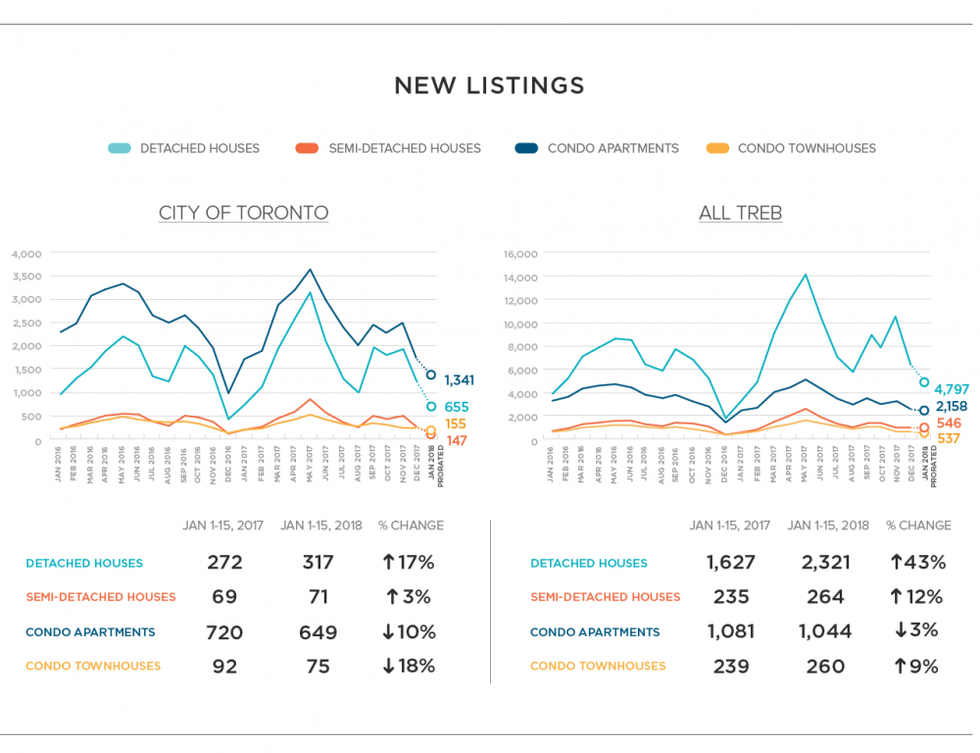

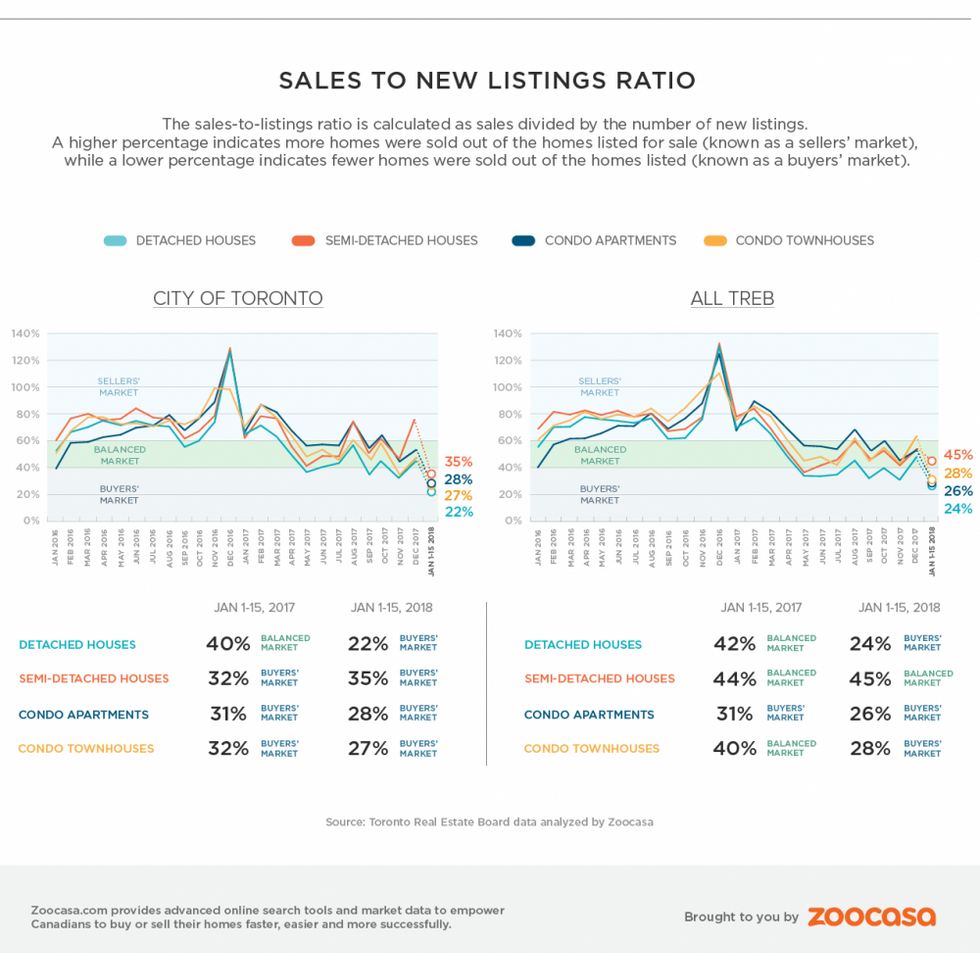

Throughout the total TREB region, sales have plunged 21 per cent year over year, and are down 19 per cent in Toronto. Meanwhile, new listings coming to market have shrunk by three and 10 per cent, respectively. That’s led to sales-to-new-listings ratios of 26 per cent in TREB, and 28 per cent in the 416 — indicative of a buyers’ market.

The sales-to-new-listings ratio is a metric used by real estate boards to determine the level of interest and competition in a specific market, whether on a national scale or simply by neighbourhood. According to the Canadian Real Estate Association, a ratio between 40 and 60 per cent reflects balanced conditions, while below and above those thresholds are buyers’ and sellers’ markets, respectively.

Townhouses: Too few options to make a dent

Toronto townhouses remain a bastion of affordability for those seeking more space than a condo, but can’t swing a detached home. Nonetheless, townhomes have also kicked off the year with slower sales, absorbing 24- and 31-per-cent declines in the TREB and 416 regions. Both areas remain firmly in buyers’ territory at 27 and 28 per cent. However, this could be reflected by lack of inventory rather than demand, particularly in Toronto proper, where 18 per cent fewer townhomes were listed: Only 75 units came to market in the city, and 260 in TREB total, compared to the 649 and 1,044 condo units.

Softer sales and prices for detached houses

There has been a surge in the number of houses for sale in Toronto. Following the implementation of the Ontario Fair Housing Plan last April, anxious sellers looked to cash out in a softening market.

There were 20-per-cent fewer houses sold within the first two weeks of the January market, with only 548 changing hands in the TREB region, and 71 sold in Toronto — a plunge of 31 per cent. The sales-to-new-listings ratio for each are 24 and 22 per cent, indicating buyers’ conditions continue to linger for real estate’s priciest segment.

Semi-detached bucks the trend

Semi-detached homes appear to be the only housing type that has seen an increase. It shows sales of 15 and 14 per cent, and activity outpacing new inventory coming to market (+12 per cent in the TREB region, and +3 per cent in the 416). While conditions are still favourable to buyers in Toronto at 35 per cent, they’re more balanced in the rest of the region at 45 per cent.

This comparatively strong demand could be due to more buyers seeking less expensive alternatives to detached homes. But with the freehold status, land, and square footage, semi-detached homes often provide at a cheaper price point.