Toronto

When it comes to Amazon's HQ2, Toronto should be careful what it wishes for (Financial Post)

Amazon.com Inc. has turned the search for a home for its second headquarters (HQ2) into an episode of The Bachelorette, with cities across North America trying to woo the online retailer.

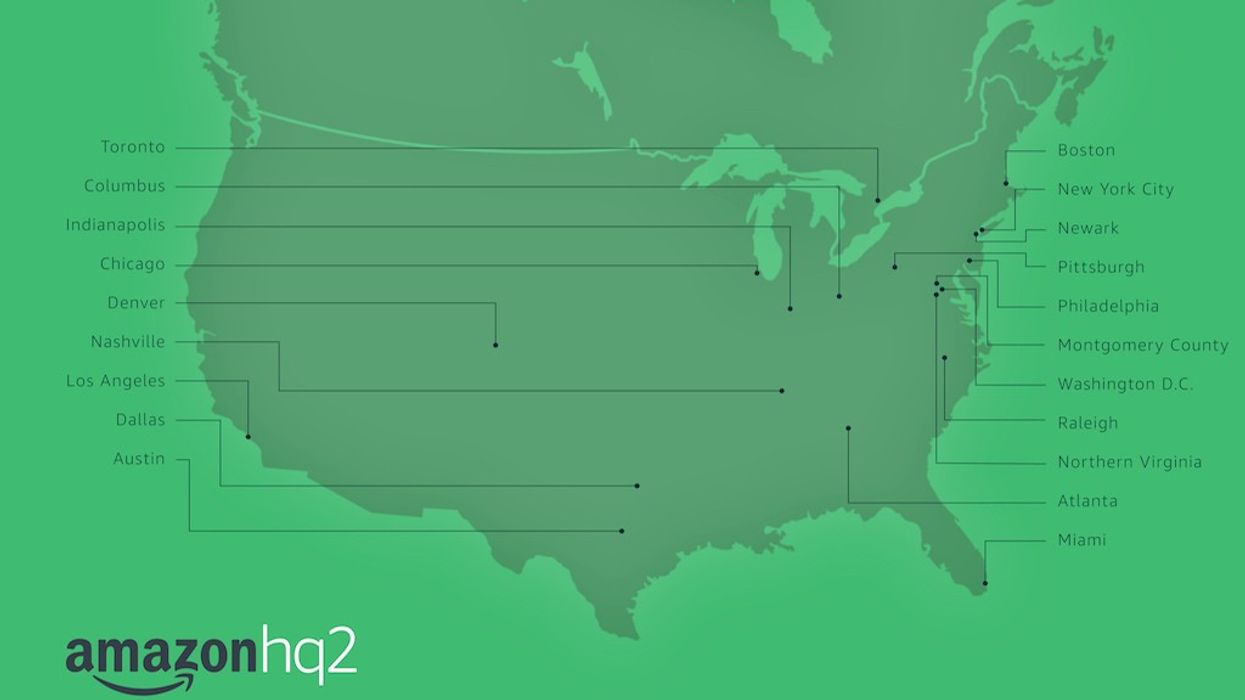

The Seattle-based tech giant has narrowed down the choice to 20 cities, with Toronto being the only Canadian location in the running.

Rental prices rise sharply in the GTA amid low vacancy, fierce tenant competition (Globe and Mail)

Apartment rents climbed sharply in the Greater Toronto Area in 2017 as population growth and low supply pushed vacancy levels below 1 per cent.

The Toronto Real Estate Board (TREB) said the average rent for a one-bedroom condominium apartment in the GTA climbed to $1,970 in the final quarter of last year, while rent for a two-bedroom condominium apartment rose 8.8 per cent to $2,627.

The Future Of The Toronto Housing Sector: Dubious? (Hibusiness)

According to a CMHC analyst, even though the Toronto residential real estate sector has been the nerve center for sales activity and price expansion, the city is now entering a stage where things become more erratic for the housing market.

As quoted by CBC news, Dana Senagama said “I think we’re at a critical time in terms of the market and hard to tell where exactly it’s going to turn. But I do think things will start to slow”.

Canada

Legal marijuana shops could boost nearby property values, study shows (CBC News)

While Ontario landlords are looking to ban marijuana use in their rental units and several municipalities don't want

legal cannabis stores in their neighbourhoods, experts and a U.S. study suggest that recreational pot could lift property values.

Property prices for homes in Denver near shops which converted from medical marijuana to recreational pot in 2014 saw values increase by 8.4 per cent, compared to those slightly further away, the study by professors based in Wisconsin, Georgia, and California found.

Edmonton on a condo roller coaster (Globe and Mail)

Edmonton's condo market is either on life support or looking forward to a great 2018, depending on who you ask and what kind of building you're talking about.

Recent numbers from the Realtors Association of Edmonton suggest fewer condos were sold in the region at any time in the past five years, and prices fell with the volume: steep drops in November and December saw prices for condos dip three per cent lower than the same period in 2016.

Condos approved for North Vancouver Telus site (Business in Vancouver)

North Vancouver city council voted this week to allow for 179 condo units at 150 East Eighth St. in North Vancouver.

The condos will share the site with Telus’ office building at that location.

USA

Fault in our stars’ homes: Beverly Hills could face magnitude 7 earthquake (RT)

Geologists have discovered new fault lines in Southern California that could flatten some of the most luxurious retail stores and high-end real estate in Beverly Hills, Hollywood and other heavily populated areas of Los Angeles.

Earlier this month, the California Geological Survey (CGS) released 14 maps that show the location of new and revised fault lines under Beverly Hills, Culver City, Santa Monica, Hollywood, and elsewhere on the westside of Los Angeles.

Multifamily Market Trajectory in U.S. to Continue in 2018 (World Property Journal)

According to a new report by Freddie Mac, the U.S. multifamily market will see continued strength in 2018, largely mirroring last year's performance.

Freddie Mac's Multifamily Research and Modeling Vice President Steve Guggenmos and Manager Sara Hoffmann find that the moderated growth the market saw in 2017 will continue through 2018. Originations will set another record this year, while rents will keep growing at current levels due to a healthy labor market and continued lifestyle preferences toward renting. Additionally, they forecast that over the next year, completions will peak and supply will increase only slightly faster than demand. While vacancy rates are expected to continue their upward trajectory at the national level and in most metropolitan areas, vacancies in most locations will remain below their historical averages through 2018.

Bad Blood: Elliman accuses Taylor Swift entity of stiffing broker on commission (The Real Deal)

Sorry, the new Taylor can’t come to the phone right now. Why? Probably because her companies are being sued by Douglas Elliman.

The pop star’s LLC stiffed an Elliman broker on the commission for the Tribeca townhouse she bought last year for $18 million, according to a lawsuit filed on Thursday in New York Supreme Court. Though an Elliman broker showed Swift representatives the townhouse at 153 Franklin Street, another broker took the commission for the deal. Elliman is seeking roughly $1.1 million in damages — or roughly 6 percent of the property’s purchase price.

International

Hong Kong Home Prices Rise at Fastest Pace in 5 Years in 2017 (World Property Journal)

According to JLL's latest Hong Kong Property Market Monitor, Hong Kong's housing market continued to reach new heights in December, capping off a year that saw capital values advance at their fastest pace in five years. Capital values of mass residential properties increased by 1.3% m-o-m in December to lift full-year growth to 15.8 percent.

Denis Ma, Head of Research at JLL commented, "Despite being at record high levels, we expect housing prices to continue to move higher as we enter the New Year. Market sentiment remains high, as evidenced by strong sales in the government land and primary sales markets, and will be further buoyed by the recent stock market rally. We are forecasting housing prices to increase a further 10% in 2018 but as much as 20% if the current momentum in the market is sustained.