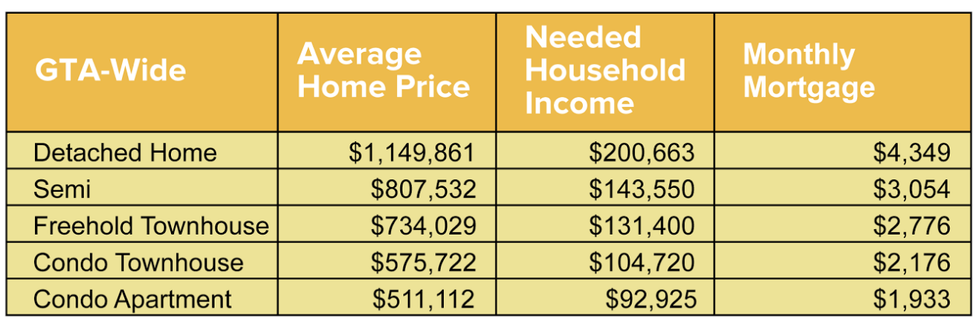

On average, you need a six-figure household income to afford almost every type of home in the Greater Toronto Area (GTA), from detached houses and semis to townhomes. The exception are condo apartments, which, even though they have climbed this year, means you’ll need one less zero at the end of your paycheck.

That’s according to a new study by Toronto-based real estate brokerage TheRedPin.com, which measured the salary needed to afford a property based on average sold prices from Jan. 1 to July 31 this year.

- The chart represents average prices for the entire Greater Toronto Region (cumulatively the City of Toronto and the surrounding suburban regions of York, Peel, Halton and Durham).

What’s behind the calculation?

To calculate home affordability, TheRedPin used the mortgage industry’s benchmark of a 32 per cent Gross Debt Service Ratio, which essentially means no more than one-third (or around 32 per cent) of your income should go towards home expenses such as mortgage payments, property taxes and utilities.

TheRedPin also assumed a down payment of 20 per cent with a 2.99 per cent, five-year fixed mortgage rate and 25 years’ amortization.

Housing affordability at an all-time low

The study reinforces how out-of-reach detached houses are for many GTA home buyers, as average prices in 2017 sit well above the million-dollar mark and require more than $200,000 in total household earnings.

Aside from having to earn high incomes, another huge hurdle for buyers looking to snatch up the average million-dollar detached home is the down payment. A 20 per cent down payment is the minimum amount required for properties with seven-figure price tags, as the Canadian Mortgage and Housing Corporation (CMHC) won’t provide insurance for properties above $1 million. So that means you’ll need at least $200,000 on-hand for your deposit.

The findings also put a sharp focus on the fact condo apartments, the de-facto option for many first-time buyers, are quickly losing their status as being at least somewhat affordable as their price-points climbed to new heights in 2017.

Getting local

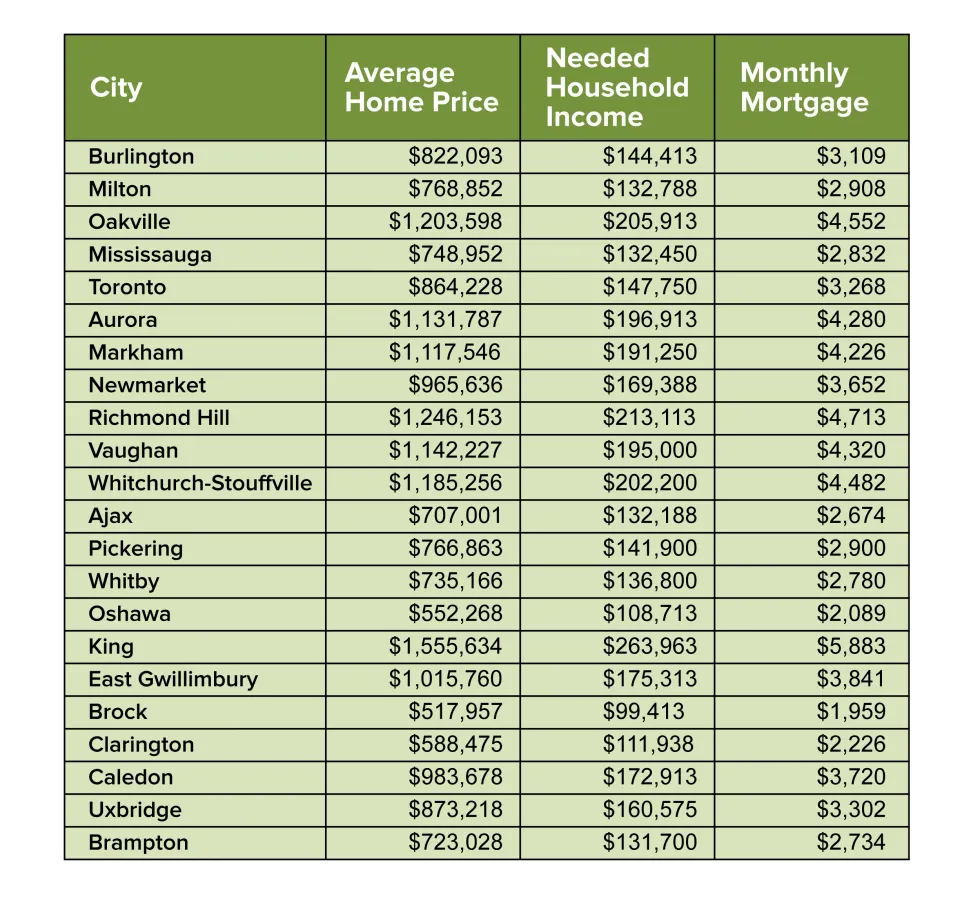

While looking at the GTA as a whole is all well and good, most people really want to know how affordability looks like in their city.

So, TheRedPin also broke down the salary you need to afford an average property in 22 major GTA municipalities, factoring in collective average prices for all home types on a city-by-city basis.

Silver lining

As with almost all analysis of the housing market, TheRedPin factored in average sold prices in its calculations. While averages are useful in providing a broad overview of the market, by no means do averages always prove relevant in your personal house hunt.

After all, there are several detached homes in the GTA that sell for less than $1 million and in even some (extremely rare) cases, you can even find uber cheap condos in Toronto that sell for around $150,000.

Ensure you connect with your realtor and mortgage specialist in order to figure out what you and your family can afford. While options exist for a variety of budgets and incomes, you may have to scratch several things off your list of must-haves and add some extra time commuting. Well worth it however if you find your ideal home.